Good morning. Happy Thursday.

Several Asian/Pacific markets were closed today. The ones that opened closed down or flat. Japan dropped 2.5%; Australia, China and India also fell. Europe is currently mixed. Austria and Stockholm are down; Norway and Greece are up. Futures here in the States point towards an up open for the cash market.

The dollar is up big (0.5%). Oil is up, copper down. Gold and silver are down.

Facebook (FB) kicked butt with earnings. The stock is up almost 18% in premarket trading and will open at a new all-time high.

Google (GOOG) is selling Motorola to Lenovo only two years after acquiring the company for a much higher price. But it’s not a total loss. GOOG is keeping much of Motorola’s intellectual property.

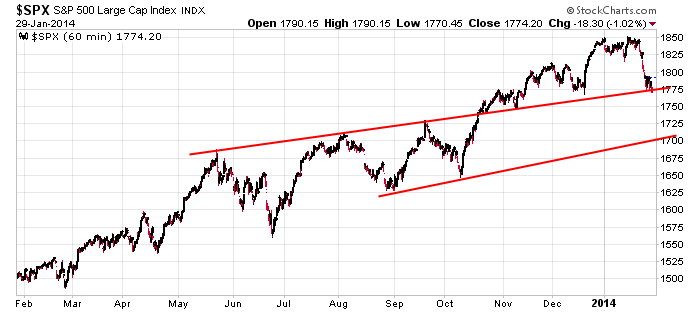

Here’s an update of the 60-min S&P chart I’ve been posting. The index closed right at a trendline which has only been penetrated once. It also happens to be the December low.

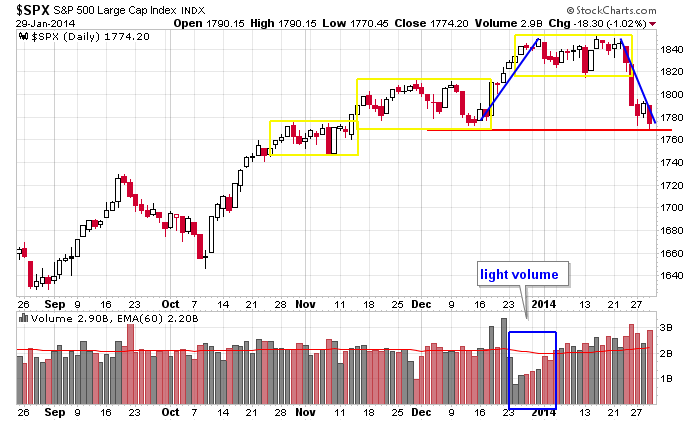

Backing up with the daily, you see the market has spent most of the last three months range bound. A one-week mid December rally and one-week end-of-January sell-off are the only noticeable directional moves. Otherwise the market has traded quietly in a range. You gotta be a good stock picker to make money in such an environment. The starting point is always identifying the strongest groups. More after the open.

Stock headlines from barchart.com…

ConocoPhillips (COP -0.59%) reported Q4 EPS of $1.40, stronger than consensus of $1.32.

Harley-Davidson (HOG -1.34%) reported Q4 EPS of 34 cents, higher than consensus of 33 cents.

Time Warner Cable (TWC -1.20%) reported Q4 EPS of $1.82, higher than consensus of $1.73.

Whirlpool (WHR -1.58%) reported Q4 EPS of $2.97, weaker than consensus of $3.03.

AutoNation (AN -0.80%) reported Q4 EPS of 83 cents, better than consensus of 76 cents.

Viacom (VIAB -1.57%) reported Q1 EPS of $1.20, higher than consensus of $1.16.

Raytheon (RTN -0.65%) was awarded a $107.92 million modification to a government contract for work on the Patriot missile system.

Gates Capital reported a 5% passive stake in International Game Technology (IGT -1.35%) .

Google (GOOG -1.43%) rose 2% in after-hours trading after it announced that Lenovo Group (LNVGY +3.57%) bought its Motorola handset unit for $2.91 billion.

Las Vegas Sands (LVS -1.77%) reported Q4 EPS of 87 cents, stronger than consensus of 85 cents.

Flextronics (FLEX +0.52%) reported Q3 adjusted EPS of 26 cents, higher than consensus of 23 cents.

Lam Research (LRCX +0.06%) reported Q2 adjusted EPS of $1.10, stronger than consensus of $1.03.

Tractor Supply (TSCO -2.38%) reported Q4 EPS of 68 cents, better than consensus of 65 cents.

Facebook (FB -2.92%) jumped 13% in after-hours trading after it reported Q4 EPS of 31 cents, higher than consensus of 27 cents.

Hanesbrands (HBI +1.40%) reported Q4 adjusted EPS of 98 cents, better than consensus of 90 cents, and then raised guidance on fiscal 2014 adjusted EPS to $4.60-$4.80, much better than consensus of $4.48.

Spectrum Brands (SPB -1.61%) reported Q1 adjusted EPS of $1.09, well ahead of consensus of 99 cents.

Qualcomm (QCOM -1.21%) reported Q1 adjusted EPS of $1.26, stronger than consensus of $1.18, but then lowered guidance on Q2 adjusted EPS to $1.15-$1.25, below consensus of $1.26.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 GDP Q4

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

1:00 PM Results of $35B, 5-Year Note Auction

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ABFS, ABMD, ADT, AIT, ALXN, AN, ARG, ATK, BC, BEAV, BEN, BLL, BMS, BTU, BX, BZH, CAH, CAM, CARB, CELG, CEVA, CL, CMS, COP, CRR,CRS, DFT, DGX, DOV, DST, EPD, ERIC, ESI, HAR, HGG, HOG, HP, HSH, HSY, IVZ, KELYA, KEM, KMT, LLL, LLY, MAN, MD, MMM, MO, NOC,NVO, OSTK, OXY, PBI, PHM, PLD, POT, RGLD, RTN, RYL, SHW, TE, TEN, TKR, TMO, TWC, UA, UPS, UTEK, V, VIAB, VLY, WCC, WHR, XEL, XOM, ZMH

Notable earnings after today’s close: ABAX, AFG, ALGN, AMZN, ARAY, AVNW, AZPN, BCOV, BCR, BRCM, CB, CLS, CMG, CNI, CPHD, CPSI, CPT, CSC, CTCT, CYT, DLLR, ELX, EMN, ESS, GDOT,GOOG, JDSU, LSTR, MCHP, MCK, MCRS, MTW, N, NATI, NEU, NGVC, PFPT, PKI, PMCS, RGA, RHI, RVBD, SIMG, SYA, TSYS, TUES, UIS, VR, WYNN

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 30)”

Leave a Reply

You must be logged in to post a comment.

My models tell me we have at least a short term bottom and can expect a bounce. I would like to have seen the total PC ratio above 1 before going long. It is at .94 for those that don’t care to look it up.

Jason… Remember what you said about bears going bullish.

AAII survey reveals lowest bullish stance since Sept.

http://www.aaii.com/sentimentsurvey/sent_results

First time claims up 19000, but The latest GDP figure 3.2% is just the first of three estimates which will be made by the Commerce Department. But, will stay up? Not likely inventory’s are up too much for average sales. Taper seems to be having less affect on the market than feared. Japanese QE is still full speed ahead. Canada dollar down. what does that mean??

SP up 6-7pts. This says maybe an attempt to rally today, but overall, the recent market makes me reluctant to risk much until I see where the big money is headed. Watching gold for a quick spike up. Watch volumes which are running lower recently. We need retail investors back in the market big time.

Thurs was pretty if you are a bear, pretty ugly if you are a bull.

However, notice that the bears pushed into the layer of support, and the bulls defended it. Note Jason’s comment about the trendline at approx 1775. Looks like we’ll open with a bounce off it.

So, the layer of support is the same as mentioned yesterday. “1780 and extending lower now, with the lowest level at 1754. Wide range.”

Near term support for this morning: 1778 down thru 1774.

There is a lot of resistance all the way up.

Since I will be on travel thru early next week and unable to post, let me give you the most significant layer of resistance to watch for: 1810 up thru 1820. If that is broken, bulls definitely have control. And assuming they get there, they’ll look like they have control in the process.

Futures +12 ATT.

See you Wed.