Good morning. Happy Friday.

Many of the Asian/Pacific markets were closed again. Japan closed down 0.6%. Europe is currently mostly down. France, Germany, Switzerland, Italy, Spain and London are down more than 1%. Futures here in the States point towards a big gap down open for the cash market.

Join our email list and be reminded of blog updates.

The dollar is up slightly. Oil and copper are down. Gold and silver are up.

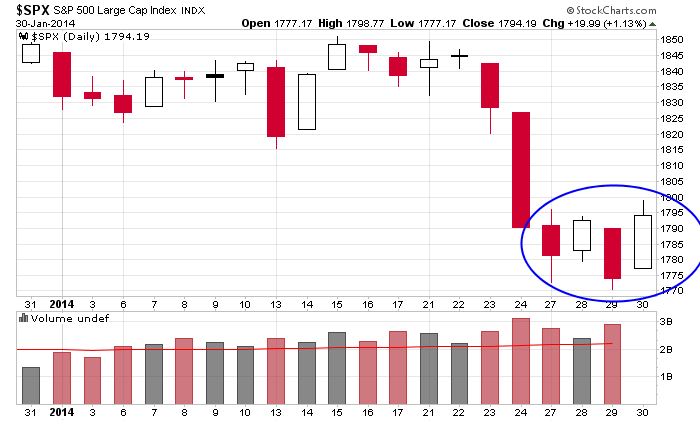

Here’s the daily S&P with the last four days highlighted. Down, up, down, up. Bulls feel like idiots one day and geniuses the next. Same with the bears. Today we’ll get a big gap down, so the back and forth trend will continue…at least at the open.

Microsoft (MSFT) has named a new CEO.

Big tech is moving in different directions.

Apple (AAPL) got crushed after earnings. Amazon (AMZN) is getting clobbered right now…it’s down 32 bucks pre-market. Google (GOOG) on the other hand is up 45 bucks. Chipotle (CMG) is up 58 bucks (I know, it’s not a tech stock). Companies are either knocking the ball out of the park or missing expectations. Risk is higher this earnings season then recent memory. I’m glad I’m laying low and taking a wait-n-see approach.

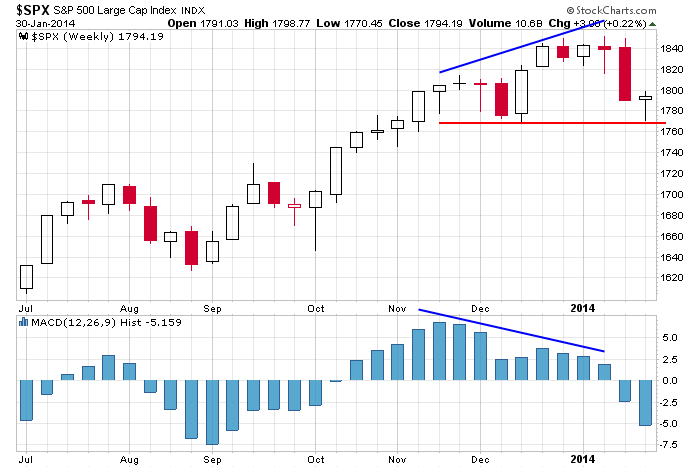

Today is the last day of the week, so let’s check out the weekly chart. The divergence played out perfectly. The S&P dropped 80+ points and so far has found support at a previous low. The index will have to rally off today’s open if it’s to close up on the week.

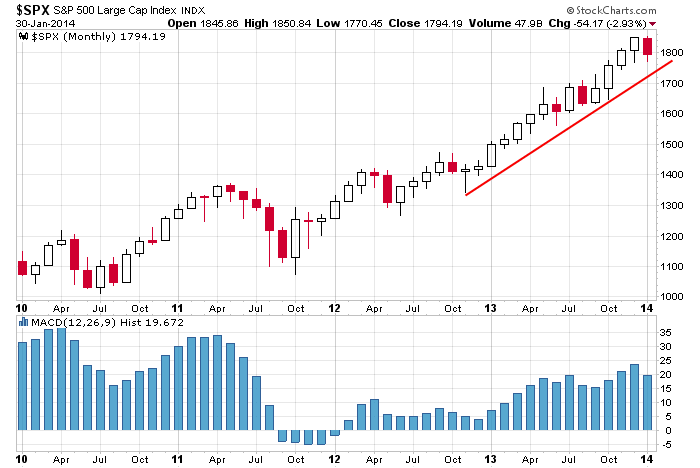

Today is also the last day of the month, so let’s check out the monthly. The chart is rock solid. As of today’s close the indexes will have moved up 12 of 15 months with no noticeable corrections. This is probably the most bearish statement/observation I can make – that the move is unsustainable and the market has gone up so much without even a 5% pullback, eventually buyers are going to resist paying these lofty prices.

If you don’t know what to do, stand aside.

Stock headlines from barchart.com…

Legg Mason (LM +1.71%) reported Q3 EPS of 67 cents, much weaker than consensus of 99 cents.

AON Plc (AON +1.50%) reported Q4 EPS of $1.28, well below consensus of $1.51.

Weyerhaeuser (WY +0.75%) reported Q4 EPS of 27 cents, below consensus of 28 cents.

Bank of New York Mellon reported a 5.09% passive stake in Tesco (TESO +2.63%) .

Eastman Chemical (EMN +1.71%) reported Q4 EPS of $1.35, better than consensus of $1.25.

Wolverine Asset reported a 5.1% passive stake in Comtech (CMTL +0.13%) .

Manitowoc (MTW +1.89%) reported Q4 adjusted EPS of 47 cents, better than consensus of 34 cents.

CSC (CSC +2.07%) reported Q3 EPS of 94 cents, well ahead of consensus of 84 cents, and then raised guidance on fiscal 2014 EPS to $3.80-$3.90, stronger than consensus of $3.68.

Symetra Financial (SYA +0.77%) reported Q4 adjusted EPS of 42 cents, better than consensus of 39 cents.

B. Thomas Golisano reported a 10.4% passive stake in Paychex (PAYX +0.62%) .

C.R. Bard (BCR +0.54%) reported Q4 adjusted EPS of $1.42, higher than consensus of $1.39.

McKesson (MCK +2.28%) reported Q3 adjusted EPS of $1.45, well below consensus of $1.85, and then lowered guidance on fiscal 2014 adjusted EPS to $8.05-$8.20, weaker than consensus of $8.31.

Broadcom (BRCM +1.81%) reported Q4 EPS of 60 cents, better than consensus of 57 cents.

Wynn Resorts (WYNN +3.94%) reported Q4 adjusted EPS of $2.27, well above consensus of $1.74.

Amazon.com (AMZN +4.90%) slid 5% in after-hours trading after it reported Q4 EPS of 51 cents, well below consensus of 66 cents.

Google (GOOG +2.57%) reported Q4 EPS of $12.01, below consensus of $12.26.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Personal Income and Outlays

8:30 Employment Cost Index

9:45 Chicago PMI

9:55 Reuters/UofM Consumer Sentiment

3:00 PM USDA Ag. Prices

Notable earnings before today’s open: ABBV, ALV, AON, AVY, BAH, BPO, CNX, CVX, D, IMGN, KCG, KFN, LEA, LM, LYB, MA, MAT, MJN, MOD, NOV, NWL, PCAR, SAIA, SPG, TSN, TYC, WETF, WY

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 31)”

Leave a Reply

You must be logged in to post a comment.

Great weather. 8 foot snow banks, have not seen the sun in weeks. Sub zero temperatures and the wind is blowing.

I am sure it is better where Jason is. The Packers are not playing this weekend so I won’t watch.

BUT cross your fingers for the Seahawks Paul. In Seattle it is 50 degrees F and I am playing golf this afternoon; I will think of your snow banks, not much, of course. Cheers.

Emerging markets are driving a downer today and for months to come. EU still not able to hold disinflation off another downer. Government reports: the consumer gets no greater income, but spends more. Saving suffers obviously. Inflation is showing 1.2% which is better than deflation (but probably wrong too since much else says deflation is inevitable.) New book: The Age of Oversupply, says the world in making too products, and offering too many services. But wants more borrowing and spending by government. He is wrong of course, but is shows that even Wall Street does not care about recovery as much as current income. Damned Hack.

All of models suggest 2014 is headed towards the most volatile year since 2007. Not good, Cash is best maybe; Probably bonds will rise in price. Stocks seemed doomed to become short term speculations – trades : Jason’s services will be the way to go for most of us.