Good morning. Happy Thursday.

The Asian/Pacific markets leaned to the upside. China, Indonesia and Taiwan did well; Hong Kong and Singapore lagged. Europe is currently mixed. Russia is down 1.4% followed by Belgium and Greece. Prague and Spain are doing well. Futures here in the States point towards an up open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are little changed.

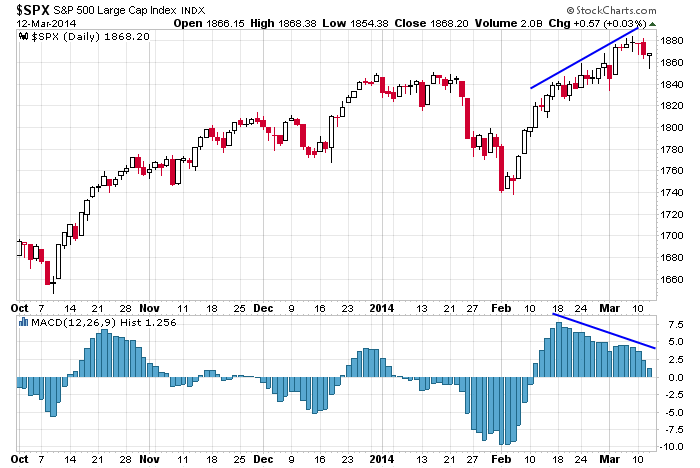

I think today carries a little more importance than usual. On one side, the S&P daily is still working off a negative divergence with it MACD Histogram. But yesterday the market opened weak and then rallied and closed at its high. It was the biggest intraday up move the market has enjoyed this month. For the bulls’ sake, I would not want to see the move immediately reversed. If prices can move up again today, it’ll be a definite sign of strength…that despite some headwinds (technical and otherwise) the bulls were strong enough to only allow a minor pullback. Here’s the daily S&P.

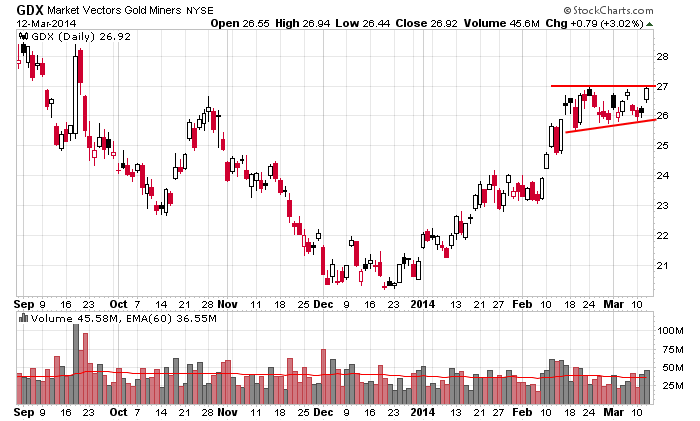

Gold and silver remain my favorite groups right now. Here’s GDX, a gold ETF. It doesn’t get much more textbook than this…a consolidation pattern within a newly formed uptrend (at least on an intermediate term time frame). As highlighted in last night’s PM Obs, there are many great looking gold and silver charts setting up right now.

Stock headlines from barchart.com…

Genesco (GCO -0.37%) reported Q4 adjusted EPS of $2.16, below consensus of $2.18.

National Oilwell (NOV -0.99%) was downgraded to ‘Neutral’ from ‘Buy’ at ISI Group.

Kirkland’s (KIRK +0.43%) gave guidance for 2014 EPS of 90 cents-$1.00, below consensus of $1.06.

Electronic Arts (EA +0.60%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill.

Activision Blizzard (ATVI +2.64%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

Jefferies kept its ‘Buy’ rating on Adobe (ADBE +0.87%) and raised its price target on the stock to $80 from $65.

Steelcase (SCS -0.47%) downgraded to ‘Neutral’ from ‘Buy’ at Longbow.

Dollar General (DG -0.19%) reported Q4 EPS of $1.01, right on expectations.

Northrop Grumman (NOC +0.53%) was awarded a $750 million government contract modification to a previously awarded contract for development of the Ballistic Missile Defense System’s Command, Control, Battle Management, and Communications Systems.

Williams-Sonoma (WSM -0.03%) climbed over 6% in after-hours trading after it reported Q4 EPS of $1.38, better than consensus of $1.36.

SAC Capital reported a 5.6% passive stake in Momenta Pharma (MNTA +3.31%) .

Vail Resorts (MTN +0.18%) reported Q2 EPS of $1.60, below consensus of $1.87.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Retail Sales

8:30 Initial Jobless Claims

8:30 Import/Export Prices

9:45 Bloomberg Consumer Comfort Index

10:00 Business Inventories

10:00 Hearing: Nomination of Stanley Fischer as Vice Chairman of the Board of Governors of Federal Reserve

10:30 EIA Natural Gas Inventory

1:00 PM Results of $13B, 30-Year Note Auction

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AMRC, CBK, DG, DXM, GCO, GOGO, KIOR, MEI, PGNX, PHMD, PLUG, SNMX

Notable earnings after today’s close: ADES, ANAC, ARO, AVEO, BODY, CBEY, EAC, FXEN, GST, KRO, MFRM, SEAS, ULTA, ZUMZ

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers