Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Japan dropped 3.3%; Hong Kong and Australia more than 1%. Indonesia rallied 3.2%. Europe is currently down across-the-board. Belgium, Russia, Prague and Spain are down more than 2%. France, Amsterdam, Stockholm and Greece are down more than 1%. Futures here in the States point towards a slight down open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

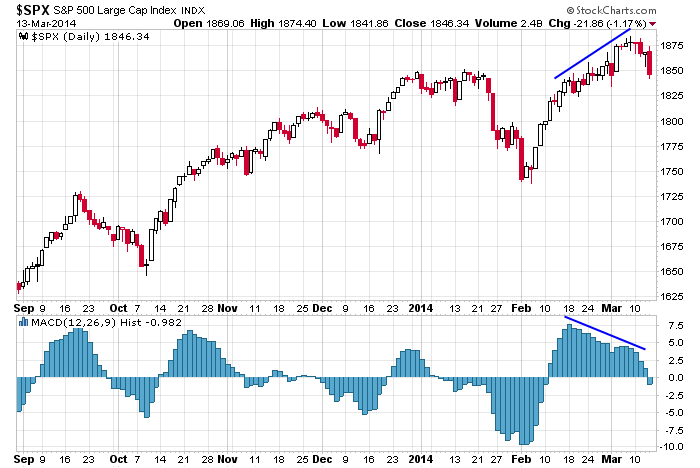

The market got hit hard yesterday. It was the biggest down day since the early-February bottom, and the S&P is on pace to suffer one of its biggest down weeks since August. Here’s the daily. A divergence with the MACD Histogram is not to be ignored.

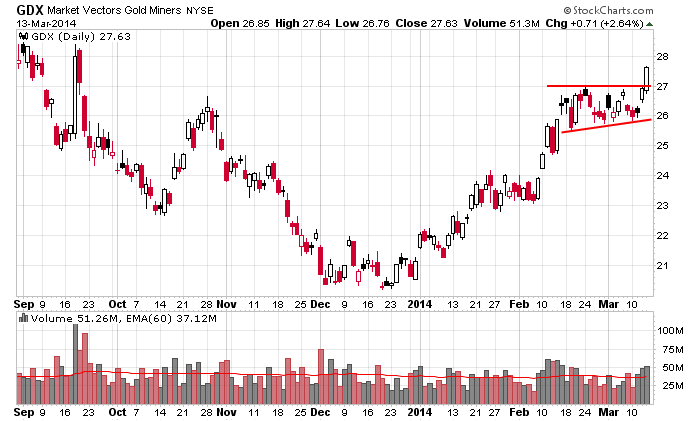

But it wasn’t a total loss. Our gold and silver set ups did great. Purely from a technical standpoint, the groups look great and should continue their newly formed trends. Here’s GDX. Textbook play if you’re looking for low risk/low reward. Many individual stocks look just as good and have better upside potential.

Warnings have been flashing for the last week…mostly in the form of numerous groups and stocks hitting nose-bleed levels. The overall trend remains solidly up, but in the near term, being cautious has been my call. More after the open.

Stock headlines from barchart.com…

Lowe’s (LOW -1.36%) was upgraded to ‘Outperform’ from ‘Perform’ at Oppenheimer.

Ann Inc. (ANN -0.09%) reported Q4 EPS of 10 cents, better than consensus of 7 cents.

Cooper Tire (CTB -1.17%) reported Q4 EPS of 31 cents, stronger than consensus of 26 cents.

Brown Shoe (BWS +0.75%) reported Q4 EPS of 14 cents, higher than consensus of 10 cents.

General Mills (GIS -0.66%) lowered guidance on Q3 adjusted EPS to 61 cents-62 cents, below consensus of 68 cents.

U.S. Steel (X -1.85%) was downgraded to ‘Underperform’ from ‘Neutral’ at Credit Suisse.

NuStar Energy (NS -0.04%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman.

Gabelli reported a 5.76% stake in Cadence (CADX -0.07%) .

Aeropostale (ARO +0.69%) fell over 10% in after-hours trading after it reported a Q4 EPS loss of -35 cents, wider than consensus of a -31 cents loss.

Ulta Salon (ULTA -2.06%) rose over 5% in after-hours trading after it reported Q4 EPS of $1.09, better than consensus of $1.07.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Producer Price Index

9:55 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: ANN, BKE, BWS, EBIX, FSYS, HIBB, KWK, MEA

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 14)”

Leave a Reply

You must be logged in to post a comment.

to save the end of the world

i have bought my pet bull –gurtrude- a new chinesse dress

this will help the china economy and gurtrude may be able to led the bears astray

looking for a bounce around spx 1840 ish

but will only play the 1 and 5 minute intraday charts

ftse and dax having a bounce now but is it substainable

They made their way down to the support of interest as expected.

This is a significant layer of support, and since it is based on a large period of time, it is very wide. Starts at y’day’s low 1842 and extends down to 1824. With that large risk, it carries a large target, now looking at 1911.

There is plenty of resistance on the way up.

1846 and more at 1857 thru 1862. If those are cleared, expect pullbacks, then resumption of the ascent.

Futures were as high as +4.25 then swooned to -7.25 at the 830 report. Have recovered and now -1 at 905.

To AussieJS and Mike:

Thank you both for your prescient analysis.

es de

You’re welcome, es de.

thank you both for posting,Mike ,your piviots are usually spot on

well its 12.30 and europe just closed and usa all alone,on weekly opts ex and quad next week,

with the rusian thing this w/e

i think range bound rest of day but maybe down close,but i dont put a bias on intraday –just go with the flow and my snipper indicators

Aussie,

Roger that, good weekend to ya.