Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. China, Singapore and Malaysia moved up; there were no big down markets. Europe is currently up across the board. Greece is up 2.4%, and Austria, Prague and Russia more than 1%. Italy, Stockholm, Amsterdam, Germany and France are also doing well. Futures here in the States point towards a solid gap up open for the cash market.

The dollar is up slightly. Oil is down, copper up. Gold and silver are down.

The big news over the weekend comes from eastern Europe. The people of Crimea, Ukraine’s southern peninsula, voted by an overwhelming majority to secede from Ukraine and join Russia. This was no surprise. Most of Crimeans are Russian. The US and Europe has already called the vote illegal (heck, the vote took place very quickly and with Russian military within the peninsula and conducting military exercises on the boarder). We’ll see what happens. Markets around the world don’t seem to be overly concerned.

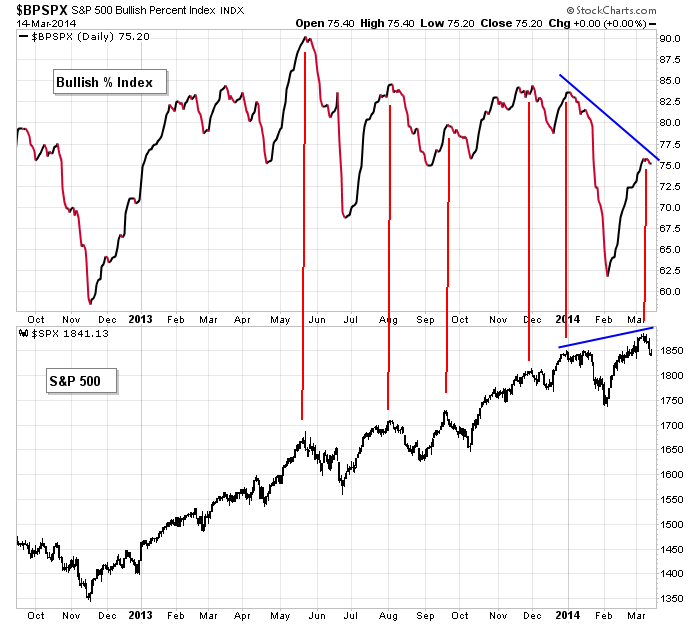

Ignoring the news, the market is in very good shape overall, but in the near term things are iffy. Several indicators are moving against overbought levels and have further to fall before reaching oversold levels (if the powers that be want them to reach oversold levels). Others nicely bounced during February and early March but are now rolling over. They can certainly right themselves soon, but if they continue to drop, odds favor more downside before the market attempts to leg up again. The bullish % chart below is an example.

So, long term the market looks great. Short term things are iffy. More after the open.

Stock headlines from barchart.com…

RBC Capital kept its ‘Outperform’ rating on Adobe (ADBE +0.16%) and increased its price target on the stock to $75 from $63.

Facebook (FB -1.61%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

JA Solar (JASO +8.25%) reported Q4 EPS of 16 cents, well above consensus of 1 cent.

GNC Holdings (GNC -0.41%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

SAP (SAP +0.61%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Siemens (SI +2.00%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

TC PipeLines (TCP +0.82%) and Martin Midstream Partners (MMLP +0.47%) were both upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Amgen’s (AMGN -1.15%) talimogene laherparepvec drug reduced the size of tumors in a Phase 3 study.

Keurig Green Mountain (GMCR +6.68%) rose over 1% in European trading after it was announced that it will replace WPX Energy (WPX -0.11%) in S&P 500 as of the 3/21 close.

Long Focus Capital reported a 8.933% passive stake in Lucas Energy (LEI -8.00%) .

Solus Alternative Asset reported a 8.91% passive stake in YRC Worldwide (YRCW +1.70%) .

UPS Freight (UPS -0.85%) announced a general rate increase of 4.4%, effective March 31.

Kylin reported a 5.9% passive stake in E-House (EJ +0.63%) .

Earnings and Economic Numbers from seekingalpha.com…

Monday’s economic calendar:

8:30 Empire State Mfg Survey

9:00 Treasury International Capital

9:15 Industrial Production

10:00 NAHB Housing Market Index

Notable earnings before Monday’s open: HNR, JASO, KIOR, LMIA, TNP

Notable earnings after Monday’s close: FF, GERN

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 17)”

Leave a Reply

You must be logged in to post a comment.

The Fed casts a long shadow. Much concern that Yellen can/will not carry out the plan. So, we trade Fed policy this week. But tell me Jason: How can we have a short run iffy market and long run looking great? Are they connected, if so how and when do it shift? Nervous when short run speculations are steering the markets.

whidbey…it’s very easy to say the long term looks great and the short term looks iffy. Within strong trends, there will be overbought conditions and mini corrections. Buy and hold investors can ignore the short term, but those who trade more actively should alternate between being aggressive and more passive based on the current state of things.

The June contract for the SPX is primary now, and issues associated with the rollover are about complete.

They held the support level of interest, and repeating what I said Fri, it starts at 1842 and extends to as low as 1824. Holding that, target is 1909, give or take.

For today, it would appear that we gap higher at the open. Would not be unexpected to pullback to 1840.

As long as 1838 is not broken, a short term target is 1857.

There is resistance at 1851 extending to 1859.

Futures were volatile overnight, dropped to about -10 shortly after the open, then rose to +10 early this morning. Now +9 at 9 am.

Don’t forget the FOMC announcement on Wed at 2. You know how volatile the price action can be at that time. It’s not unlikely that if we have moved up, they’ll drive it down to hit any stops on gains made up to that point, then take it up with those positions closed, forcing those who got stopped to chase it higher. I’m sure you know what I’m saying. Just trade knowing those antics are coming.

Jason

I agree this is not the time to go long. I do think we are in a long uptrend. My models say get in long just below the 4200 on the NAS. That said a lot of other indicators need to be aligned. Thursdays high PC was a symptom of a small bounce.

Buy low sell high or sell hi and buy low.