Good morning. Happy Thursday.

The Asian/Pacific markets leaned to the upside. Japan, South Korea and Singapore led to the upside; China and Australia posted the biggest losses. Europe is currently mostly down. Greece, Russia, Stockholm and London are down the most; there are no notable winners. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down.

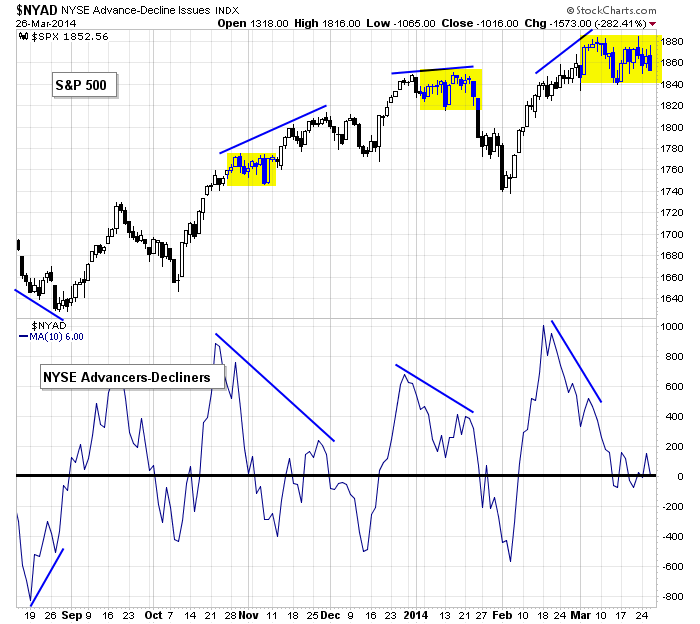

The market got hit hard yesterday…the deterioration continues. The market has been iffy for two weeks. Many technical indicators topped in mid February and then diverged from the price action at the beginning of March. Here’s an example (S&P 500 vs. 10-day MA of NYSE AD line) for those of you who don’t have access to the weekly reports (where I’ve warned of this).

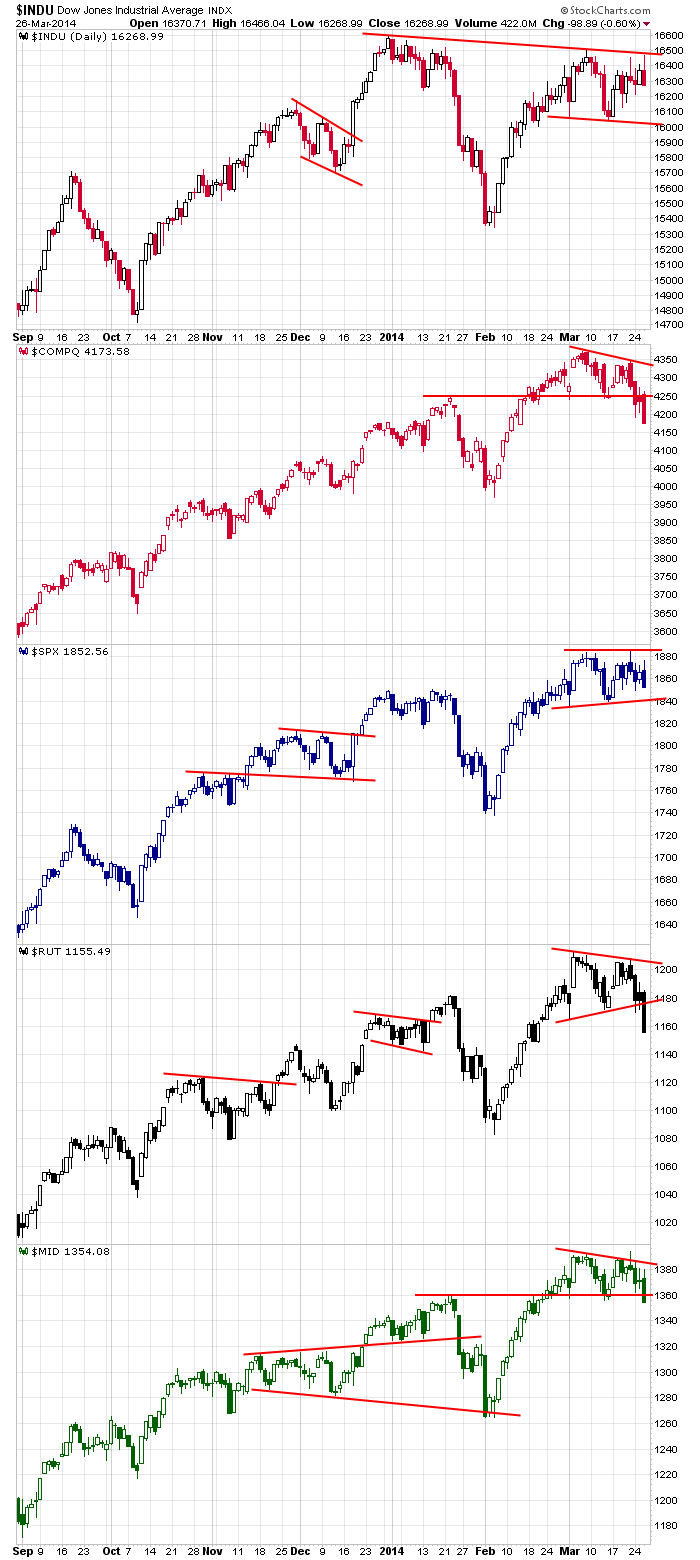

The Nas, small caps and mid caps are now sitting at their lowest level since mid February. The moves through support have been convincing…the path of least resistance is down.

But don’t get too bearish. If you’re going to argue a full-blown downtrend is in its beginning stages, you’d have to convince everyone this time is different than every other pullback we’ve gotten the last five years. It’s certainly possible, but I wouldn’t assume it’s the case. More after the open.

Stock headlines from barchart.com…

Baxter International (BAX +2.47%) announced plans to create two separate, independent global healthcare companies; one focused on developing and marketing innovative biopharmaceuticals and the other on life-saving medical products.

Signet Jewelers (SIG -1.17%) reported Q4 EPS of 2.18, higher than consensus of $2.15.

lululemon (LULU +0.50%) lowered guidance on fiscal 2014 EPS to $1.80-$1.90, weaker than consensus of $2.14.

Leidos (LDOS +0.37%) reported Q4 EPS of 56 cents, well above consensus of 45 cents.

Accenture PLC (ACN -0.66%) reported Q2 EPS of $1.03, less than expectations of $1.04, but then raised guidance on fiscal 2014 EPS view to $4.50-$4.62 from $4.44-$4.56, higher than consensus of $4.51.

H.B. Fuller (FUL -0.78%) reported Q1 adjusted EPS of 49 cents, less than consensus of 50 cents.

Essex Property (ESS -2.44%) will replace Cliffs Natural (CLF -2.03%) in the S&P 500 as of the April 1 close.

American Express (AXP -1.30%) said it will increase its quarterly dividend by 13% to 26 cents per share and that it will repurchase up to $4.4 billion of common shares during 2014 and up to an additional $1 billion in the first quarter of 2015.

Morgan Stanley (MS -1.17%) said it will double its dividend to 10 cents from 5 cents and also announced a $1 billion stock repurchase plan.

The Fed said that after its stress tests for this year it rejected the capital plans of Citigroup (C -0.28%) , HSBC North America Holdings (HSBC -0.43%) , RBS Citizens Financial Group (RBS -2.15%) , and Santander Holdings (SAN +0.99%) . The Fed also said it objected to the capital plan of Zions Bancorporation (ZION -1.31%) because the firm did not meet the minimum, post-stress tier-1 common ratio of 5 percent.

Paychex (PAYX -1.30%) rose 3% in after-hours trading after it reported Q3 EPS of 44 cents, better than consensus of 42 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 GDP Q4

8:30 Corporate Profits

8:30 Fed’s Pianalto: “The Federal Reserve and Monetary Policy”

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

9:30 PM Fed’s Evans: Economy and Monetary Policy

Notable earnings before today’s open: ACN, CMC, CONN, FRED, GME, LDOS, LULU, OTIV, SFXE, SIG, WGO, WOR

Notable earnings after today’s close: PRGS, RH, RHT

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 27)”

Leave a Reply

You must be logged in to post a comment.

Mkt went to the top of its range right out of the gate, then fell to the bottom of it. 23 SPX point swing. Does that say that we’re range bound or is it the beginning of the end? The perennial question always gets asked. The answer is the market will tell us,

it’s just that you may not get the answer as early as you want to hear it. For example, was the swoon in reaction to (possible) early leak of bad news for the bank capital plan? We know word gets out (to some, at least). On the other hand, the reaction to “good news” from the reports at 830 initially was bearish. One thing is possible, tho, a break of the bottom of the range has become more likely. But it hasn’t happened yet. Let’s see what plays out.

Outlook:

Closed Wed at support, which extends down to 1845. If that is broken,

another large layer exists at 1842 down to 1831.

Lots of resistance above resulting from Wed’s slide.

As Jason has said multo times: “trade what you see it do not what you think it should do.”

Futures high +6 to -3.25 after the 830 reports. At 9 am they’ve recovered a bit, -0.50.