Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a bullish bias. Korea rallied 1%, followed by Hong Kong (up 0.8%) and Indonesia and Taiwan (up 0.7% each). Europe is currently posting solid, across-the-board gains. Germany, Prague, Russia and Greece are up more than 1%; France, Austria, Belgium, Italy and Norway are also doing well. Futures here in the States point towards a relatively big gap up open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

At yesterday’s close I earmarked today as somewhat important. We got a big move up last Friday and a little continuation Monday morning, but then the market pulled back Monday afternoon and continued pulling back yesterday – all on declining volume. If a bottom is in place, if the buying that took place Friday was more than just short covering, the market should not drop too much further. At least that’s what I was thinking, and now we’re getting a relatively big gap up. We’ll see if it helps. Going back to the high, the S&P has closed below its open 11 out of 14 days (after taking into account the inaccurate opening print). That’s not great.

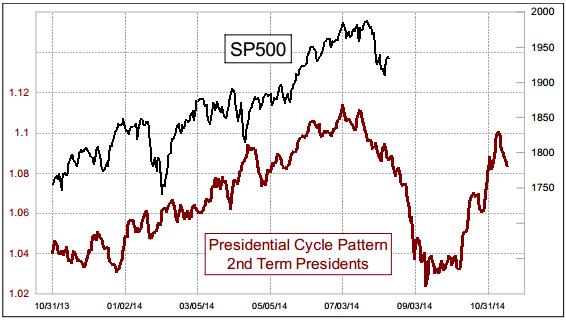

I’m seeing more charts like these floating around the internet (this one is from McClellan). Do I follow them? Well, I look at them, but that’s about it. Compiling such data used to take a big staff and hundreds of hours – now it can be done in literally minutes. Most traders would be better off not looking at such info because it hardens a bias in their mind, and they aren’t flexible to what is happening. This chart looks great, right? But what about all the comparison charts posted last year that predicted a correction? Whether it be about the presidential cycle or a new Fed Chief taking over or a certain year within a 10-year frame or the time of year or anything else. The market fails to follow historical precedent many more times than not. Again, most traders would be better of not having them. Just judge the market for what it is right now.

Stock headlines from barchart.com…

Deere & Co. (DE -0.78%) reported Q3 EPS of $2.33, higher than consensus of $2.20, but then said worldwide sales of agriculture and turf equipment are forecast to decrease by about 10% for fiscal-year 2014.

SeaWorld (SEAS +0.32%) reported Q2 EPS of 43 cents, well below consensus of 59 cents.

Southern Company (SO +0.37%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Morgan Stanley.

Demandware (DWRE +1.04%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Ford (F +0.23%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

CSR (CSRE +0.25%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Fossil (FOSL -0.93%) reported Q2 EPS of 98 cents, better than consensus of 96 cents.

JDSU (JDSU -0.50%) reported Q4 adjusted EPS of 14 cents, higher than consensus of 13 cents.

King Digital (KING +0.17%) plummeted over 20% in after-hours trading after it reported Q2 adjusted EPS of 59 cents, right on consensus, but reported Q2 revenue of $593.5 million, below consensus of $605.67 million.

Cree (CREE -0.99%) slipped 7% in after-hours trading after it reported Q4 EPS of 42 cents, better than consensus of 41 cents, but then lowered guidance on Q1 EPS to 40 cents to 45 cents, below consensus of 46 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Retail Sales

10:00 Atlanta Fed’s Business Inflation Expectations

10:00 Business Inventories

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

Notable earnings before today’s open: AIT, CAE, CSIQ, DE, EZCH, IOC, M, MEA, PF, SEAS

Notable earnings after today’s close: ANW, AZPN, CNAT, CSCO, EXXI, GEVO, IAG, NDLS, NTAP, NTES, OCLR, PAAS, SLW, VIPS, VJET, WX, XONE, YUME

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 13)”

Leave a Reply

You must be logged in to post a comment.

UK’s 6.4% unemployment announcement (lowest since ’08) early this am gave a nice lift to the futures.

Yesterday it looked like we were going to get a retracement, but they reversed it with 90 mins to go, and from there the market has roared. Futures reached +10.50 about 8 am.

We will gap up into the resistance SPX 1942 (although futures have melted from that high). We’ll need to keep going and take out 1953-54. Until we do,

we’re still under that resistance layer’s influence. How many days have I said this? Be cautiously bullish if you want, but until 1954 is cleared, this is still uncertain.

Support: It’s a ways down, but bulls don’t want to see this go lower than 1933-1934.

Futures are +6.25 at 855 am.

As to volume, as Jason says, yesterday was a nice, lo volume pullback, what you want to see after a big up-move.

Bonds are bearish.

trin 1.39…. added to my iwm short…tlt and vix working together…

Excellent.

not working out…vix and bonds now different

looks like they ran some stops on that last surge…

Bulls keep eating away on this resistance.

tlt making a move up..

getting some large blocks on es now…was very quiet…

Jim, did you notice the low near 1015am this morning was the 61.8 (2 ticks lower) retrace of the overnight low to high? Hit its target just after 11 am. Been doing not much of anything since hitting the target (except making bears nervous).

ic..yes but ive got it at the 38.2 and the high today touched the 50% retrace from the july 24 high…

Right, there are multiple fibs — the trick is to know which one da boyz is playing.

mike u holding anything? im little short iwm

Just one ctc long from 1908.50, Friday morning.

mike, hypothetical..if es is holding at 1942 and spx is at 1945.25. wouldnt spx have to catch up for the 5pt differential?

Good question, Jim.

There is always a differential between the two. We are in the Sep contract, close to its expiration. As we progress thru the contract’s life, that differential shrinks. Hard to detect on a daily basis, but over time it does, and it fluctates during the day, too, which is why sometimes in my conversion from ES to SPX, I’m off by a point.

To fully answer your question, as we near expiration that differential gets close to zero. I don’t (and most traders don’t) stick around in a contract until expiration, so I don’t actually see it go to zero, but I know that it does.

Today we’re running 3.25-3.75.

ok, now that makes sense, time decay…thx

Hi Jason,

Appreciate your efforts to get me be back on the mailing list but it hasn’t worked. I’ve been going to your website every morning to access Before the Open.

You had emailed me previously that you were deleting my email address and asked me me to start over, which I did. I tried again today to join your email list and was told it already existed – just like the last time. I only send this to you in the event others are having the same issue. I don’t mind accessing your website each morning without an email.

Pete

Question is:

Those trucks arrive in Ukraine before or after 1943-45 crossed by spx?

It will be straight up to 1952-1965 level or straight down to high 1910s.

Forgot to add, I am slowly scaling out of the VXV shorts. Will hold my long vxx puts for Aug.16 while sitting with popcorn.

Rest on the sidelines until markets decides once they hit 1952 or so.

the bulls need to get a bit fatter before the bears ambush them with a flash crash

50% retracement at spx 1948 is not enough and would be scary if the crash happened here

Agree.

However, I wouldn’t give up on the bullish notion just yet. Today’s action shows the bulls deep into the bears’ territory.

You can bet if enough people believe the chart above it ain’t happening.

It is like trading the day of the week or month of the year.