Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan, Australia and India moved up; China moved down. Europe is currently mostly up. Germany, France, Italy and London are leading the way, but gains are only moderate. Futures here in the States point towards an up open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are down.

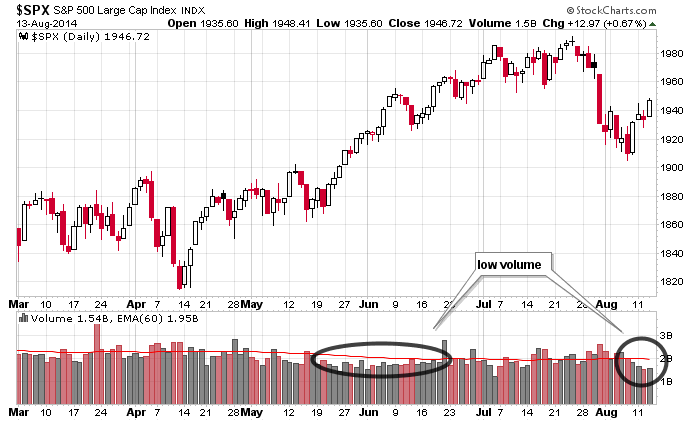

The market keeps chugging along…albeit on low volume – a sign the upward price movement stems from a lack of selling, not aggressive buying. I turned bullish last week when the positive divergence formed between RUT and SPX. Then the indicators started hitting extreme levels. Then we got a big rally last Friday. One by one characteristics of a reversal fell into place. Now the market is at its highest level in nine days. Not bad, but again, volume has been very low, and very soon the indexes will bump up against overhead resistance.

So far, so good. The market has made progress, but it’s far from being out of the woods yet. We need to see how the indexes act at previous support levels and if the indicators can turn bullish, as opposed to simply neutralizing. The low volume is notable, but it’s fairly common and not something I’ve overly concerned with. Here’s the S&P. Volume was low for the first month of the May/June rally.

Stock headlines from barchart.com…

Kohl’s (KSS -1.47%) reported Q2 EPS of $1.13, better than consensus of $1.07.

Wal-Mart (WMT -0.26%) reported Q2 EPS of $1.21, right on expectations, but then lowered guidance on fiscal 2015 EPS view to $4.90-$5.15 from $5.10-$5.45, at the lower end of consensus of $5.15.

Dresser-Rand (DRC -0.09%) was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim.

Molson Coors (TAP +0.42%) was initiated with an ‘Outperform’ at Credit Suisse with a price target of $84.

Freeport McMoRan (FCX -1.33%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Progressive (PGR +1.68%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Guess (GES -3.69%) was initiated with a ‘Buy’ at Wunderlich with a price target of $31.

Infineon (IFNNY +0.27%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Point72 Asset reported a 5.1% passive stake in Kindred Healthcare (KND +0.21%) .

Aegean Marine (ANW -0.84%) reported Q2 EPS of 20 cents, right on consensus, although Q2 revenue of $1.72 billion was higher than consensus of $1.71 million.

Cisco (CSCO +0.20%) reported Q4 EPS of 55 cents, better than consensus of 53 cents.

Infosys (INFY +0.86%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Vipshop (VIPS +4.36%) reported Q2 EPS of 72 cents, higher than consensus of 64 cents, and then raised guidance on Q3 revenue to $850 million-$860 million, better than consensus of $824.85 million.

NetApp (NTAP +0.03%) reported Q1 EPS of 60 cents, better than consensus of 57 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 Import/Export Prices

10:30 EIA Natural Gas Inventory

1:00 PM Results of $16B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAP, BGG, DANG, KSS, LRN, OTIV, PLUG, PRGO, PWE, RRGB, RSPP, SFXE, WMT

Notable earnings after today’s close: A, ADSK, AMAT, EXTR, JCP, JWN, PCTY, SINA, WB, XON

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 14)”

Leave a Reply

You must be logged in to post a comment.

Jason says “So far, so good.” And I agree with that. However, I do think we are close to being out of the woods. Or to put it another way, close to determining whether we are. The decision line is very near by.

Overnight the futures got to less than 1/2 point of breaking resistance (technically). We are currently in a pullback from that overnight high (news on the unemployment claims have assisted that pullback), and like I always say, the nature of that pullback will tell you what’s coming next.

So, as long as the pullback holds SPX 1943, watch for the bulls to make another attempt to break that SPX 1953-54.

If 1943 is broken, we’ll be headed lower, at least for the near term.

Interestingly, Investors Business Daily just changed their outlook to “market in confirmed uptrend” based on the NASDAQ “rising 1% in heavier volume.” Volume was summertime light, but it was higher than Tuesday’s, and that’s what IBD looks at.

Today is going to show us a lot.

Bonds opened slightly bullish, now are slightly bearish.

At 905, futures are unchanged after reaching a high of +4.25 at approx 0630.

bonds sure are flying…

looks like the boyz are goin to run some stops…

EEEYUPPPP. One more tick above the most recent high on ES and stand by cuz it will start getting velly intellesting.

volume is not what i thought it should be..slow grind

hmmm. time to test the es 42.50

According to my hourly readings, NYSE vol lower than y’day, NAS is higher. So the question is does the NAS pull the NYSE up or vice versa? We’ll watch and get our answer.

ES 49.50 is THE price. Last line of defense for bears.

All out Bear assault. Big time battle.

iwm is a lagger

tick has been maintained…no +1000

iwm testing the 10am low..

I’m hearing the “da dum, da dum” theme song from the first “Jaws.” Bulls are not quitting.

bonds went vertical.

Bond auction started at 1:01 eastern

ok, broke 1954; well done, bulls. Now the pullback.

pullback to 1947?

Yes, ES 1947, no lower than 1945.50 would be very bullish.

That move up to SPX 1954 + decisively broke the bears case, but

it is up to the bulls to not let any pullback get out of control.

feels like the bots have a hold on this…

Should start getting some action in the last hour.

the bulls are not in charge,the bears are in charge

apart from day trading i dont want to sell yet–maybe spx 1960 or 70

and the bulls are not doing much to help[ them selfs fatern up for execution

from cheif smarty bear