Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mixed. Taiwan rallied 1.5%; Hong Kong and Singapore also did well. Indonesia dropped 1%. Europe currently leans to the upside. Amsterdam is up 1.1%, followed by Spain and London (up 1% each), Stockholm (up 0.9%), Austria (up 0.85%) and Russia and Italy (up 0.7%). Greece is down 1%. Futures here in the States point towards a big gap up open for the cash market.

The dollar is up. Oil is down, copper up. Gold and silver are down.

Here are the employment numbers…

unemployment rate: 5.9% (was 6.1% last month)

nonfarm payrolls: +248K

private payrolls:

average workweek: up 0.1 hours to 34.6 hours

hourly wages: down 1 cent to $24.53

labor participation rate

employment gains in August revised up to 180K (from 142K).

employment gains in July revised up to 243K (from 212K)

The market’s reaction to the news has been positive. S&P futures jumped a couple points, so the day will start with an attempt to continue yesterday’s rally.

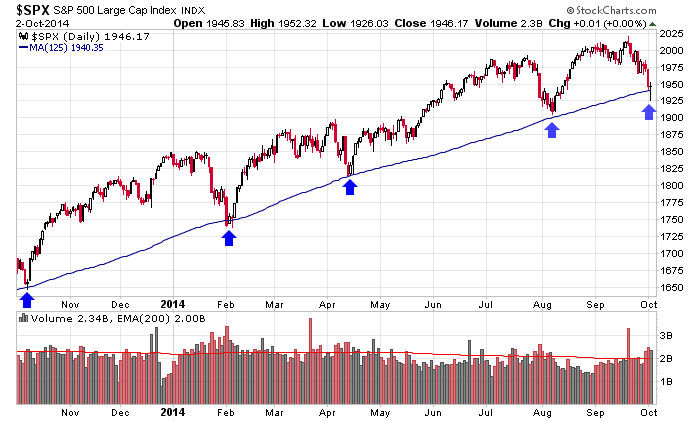

My first S&P 500 target has been hit. Here’s the chart.

For those who have short term memories, this has happened many times. The market drops, everyone gets super bearish, everyone believes a top is in place…and then after what turns out to be a very shallow move down, the market bounces and instead of it being a bounce within a downtrend or a dead-cat bounce, it keeps going and going and going. Look no further than the chart above to see how many times it’s happened in just the last year.

Am I predicting this? No. I’m just reminding you before you get too excited about the prospect of shorting this bounce. If the market doesn’t make sense, get used to it. It can not make sense for a long time.

The small caps are lagging big time; this will need to change if the market is going to sustain a rally.

Many technical indicators will need to reverse and lend evidence to improved conditions.

The market can and will do whatever it wants. Our job is to gauge the support and therefore likelihood it can continue.

Have a plan. Execute.

Stock headlines from barchart.com…

JetBlue (JBLU +3.42%) was added to the short-term buy list at Deutsche Bank.

Cree (CREE -12.04%) was downgraded to ‘Hold’ from ‘Buy’ at Needham.

Vale (VALE +2.12%) was downgraded to ‘Hold’ from ‘Buy’ at Canaccord.

Abercrombie & Fitch (ANF +0.06%) was upgraded to ‘Equal Weight’ from ‘Underweight’ at Barclays.

Halliburton (HAL -1.65%) was upgraded to ‘Equal Weight’ from ‘Underweight’ at Morgan Stanley.

SunPower (SPWR -0.06%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

Brahman Capital reported a 5.24% passive stake in Calpine (CPN -1.79%) .

Salesforce.com (CRM -0.16%) was initiated with a ‘Buy’ at Sterne Agee with a price target of $70.

Apple (AAPL +0.73%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Gabelli reported a 5.03% stake in Peregrine (PSMI +0.41%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Non-farm payrolls

8:30 International Trade

9:45 PMI Services Index

10:00 ISM Non-Manufacturing Index

11:00 Global Composite PMI

11:00 Global Services PMI

Notable earnings before today’s open: none

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 3)”

Leave a Reply

You must be logged in to post a comment.

Aussie, i would imagine the 1130-1200 est time could be a point of reversal to be engaged…

jims

not necessarily today ftse up but dax closed ,so one of the main drivers–dax is not their

euro crashed on jobs and at 125-30

europe might be muted somewhat today

short term trend still down

cash spx did hit 1961 after jobs premarket

cash price is only futures plus/minus fair value

i would like to wait till 1970 if it and other indexes get their and providing on other inds, look for a intraday short

spx R2 res piviot at 1967

futures es r2 piviot 1961

THX..alot of momentum..

fade time?

all loaded up and ready to go

even the n225 and aussie xjo

Ditto

how many contracts do u trade?

propin it up..look at iwm…

i have a mental mind set problem

to trade the contract size i would like too would give me the shivers

so i break it up to dow/spx/nas100 if adventouse the russell/ftse/dax/n225/ausssie xjo and all the futures there off

whilst each moves in tandum i like to weight the weakest to short and strongest if going long