Good morning. Happy Monday. Hope you had a good weekend.

Several Asian/Pacific markets were closed today. The open markets leaned to the upside. Japan, Indonesia and Hong Kong rallied more than 1%. Europe is currently mostly up. Russia is up 2.4%, followed by Spain (up 1.3%), Austria (up 1%) and Germany (up 0.9%). Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

The market experience intense selling at the beginning of last week and then V-bottomed Thursday and rallied hard Friday. The indexes still closed down for the week, but the closes were in the upper third of the weekly ranges.

The indicators have all moved to extreme levels and are positioned to support a market rally, if that’s what the market wants to do. Until the middle of last week, there were some holdouts, but now we get the “all clear” sign.

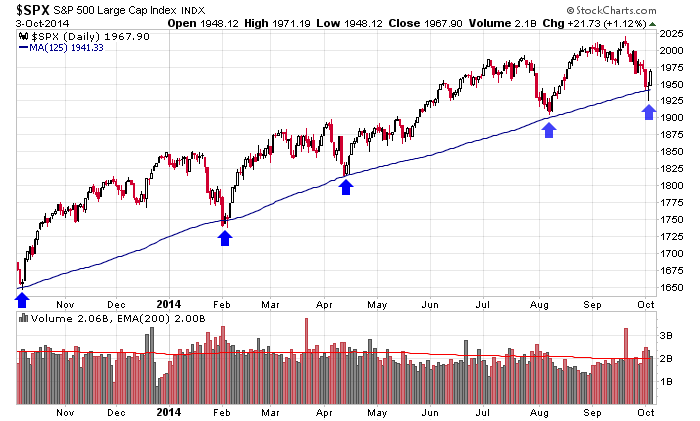

This has happened many times just in the last year. The market drops…the bears get super excited that a top is finally in…then the market bounces and Wall St. looks to short what they assume and expect is a dead-cat bounce…and the market keeps going and going and going and before they know it, a new high is put in place. I’m not predicting this, but it’s worth considering and planning for because it has happened so many times. Here’s a chart of the S&P 500 I’ve posted many times. If all you knew was this chart, nothing that has happened the last couple weeks would be considered out of the ordinary.

Stock headlines from barchart.com…

Hewlett-Packard (HPQ +2.00%) jumped over 7% in pre-market trading after the company announced that it will split into two separate companies, a personal-computer and printer business, and corporate hardware and services operations.

Burger King (BKW +1.48%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Morgan Stanley.

McDonald’s (MCD +0.79%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

L Brands (LB +1.04%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital.

Conn’s (CONN +5.75%) announced that its Board of Directors authorized management to explore a full range of strategic alternatives for the company to enhance value for stockholders, including, but not limited to, a sale of the company.

Colgate-Palmolive (CL +1.05%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Barclays.

ConocoPhillips (COP +0.11%) was upgraded to ‘Neutral’ from ‘Sell’ at UBS.

PetSmart (PETM +0.18%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Barclays.

Intuitive Surgical (ISRG +1.19%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs who also raised their price target on the stock to $584 from $466.

Laboratory Corporation of America reported a 17.7% stake in LipoScience (LPDX unch) .

EJF Capital reported a 5.9% passive stake in Sun Bancorp (SNBC +0.66%) .

Cal-Maine Foods (CALM +4.08%) announced a 2-for-1 stock split effective Oct 31 for shareholders of record at the close on Oct 17.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Gallup US Consumer Spending Measure

12:30 PM TD Ameritrade IMX

Notable earnings before today’s open: none

Notable earnings after today’s close: CAMP, IDT, TCS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 6)”

Leave a Reply

You must be logged in to post a comment.

Buy the blue arrows.

Intersection?

dax is slowly fading

im seeing +1k ticks

the dax run by alibarber sells apples

the have infiltrated the nas 100

how did u hold up with that gap up..i was underwater from friday..but now im in the money

jims

I closed most at asia trading

took a loss on usa and a bigish profit on the aussie xjo futures

re entered short at higher price in Europe trading–still holding

price went a bit higher from Friday than I though it should making that a wave 2 up

now a devilish impulsive destructive wave 3 down to zero–[ ? ?

well perhaps a few waves in between

im holding my dia puts…lookin for that 5th wave down to the 166 level