Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Taiwan, Indonesia and Singapore closed up; Hong Kong, Australia and India closed down. Europe is currently mostly up, but with the exception of Greece, which is up 4.2%, gains and losses are on the smaller side. Germany, France, Italy, Amsterdam, Norway and Prague are posting the biggest gains. Futures here in the States point towards a small gap down open for the cash market.

The dollar is up. Oil and copper are up. Gold is down, silver is up.

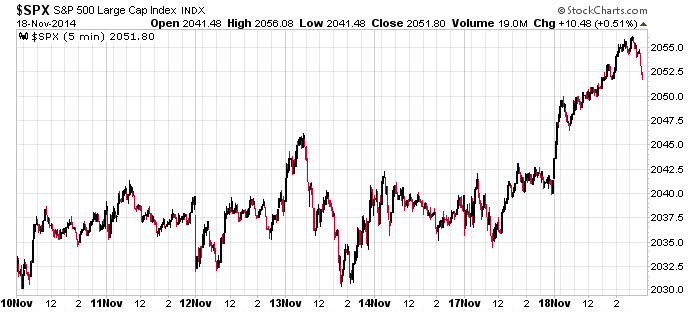

Several indexes pushed to new highs yesterday. Other than the first hour of trading, there wasn’t much energy or enthusiasm behind the move. And the breadth indicators lagged intraday, and the small caps lagged the big caps.

A new high increases the odds something happens soon. We’ll either get robust follow through, or the print will turn out to be a bull trap. Not a bull trap forever, just a new high to lure in late-comers right before the market spends some time drifting down or sideways. Be on the alert. The market has been very slow lately. Volatility has plunged, the intraday ranges have contracted and volume has fallen off. We may get a little push here in one direction or the other.

Here’s the SPX intraday chart going back seven days. Six days of range-bound movement resolved up yesterday. Follow through or mini double top that leads to a drop back into the range? Be ready.

Stock headlines from barchart.com…

Consolidated Edison (ED +0.78%) was downgraded to ‘Sell’ from ‘Neutral’ at UBS.

Columbia Sportswear (COLM +0.48%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

JM Smucker (SJM +0.44%) reported Q2 EPS of $1.53, right on consensus, although Q2 revenue of $1.48 billion was less than consensus of $1.49 billion.

Lowe’s (LOW -0.61%) rose 2% in pre-market trading after it reported Q3 EPS of 59 cents, better than consensus of 58 cents,and then raised guidance on fiscal 2014 EPS to $2.68, above consensus of $2.63.

Staples (SPLS -1.62%) climbed 2% in pre-market trading after it reported Q3 EPS of 37 cents, higher than consensus of 36 cents.

Mallinckrodt PLC (MNK +0.42%) reported Q4 EPS of $1.68, well above consensus of $1.41.

Integrated Core Strategies reported a 5.1% passive stake in Aegerion (AEGR +2.86%) .

PetSmart (PETM +0.01%) rose nearly 2% in after-hours trading after it reported Q3 EPS of $1.02, higher than consensus of 94 cents, and then raised guidance on fiscal 2014 EPS to $4.39-$4.43, above consensus of $4.33.

La-Z-Boy (LZB -0.70%) jumped over 4% in after-hours trading after it reported Q2 EPS of 36 cents, better than consensus of 34 cents.

Jack in the Box (JACK +1.72%) rose over 2% in after-hours trading after it reported Q4 operating EPS of 54 cents, above consensus of 53 cents.

Vipshop (VIPS -1.17%) reported Q3 EPS of 8 cents, better than consensus of 7 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Housing Starts

10:30 EIA Petroleum Inventories

2:00 PM FOMC minutes

Notable earnings before today’s open: CSTM, EJ, LEJU, LITB, LOW, MNK, SJM, SPLS, SSI, TGT

Notable earnings after today’s close: CPA, CRM, GMCR, HI, JMEI, LB, RGSE, SMTC, WSM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 19)”

Leave a Reply

You must be logged in to post a comment.

Kinda strange. This market is TOO quiet. Never short a dull market but going long does not give me warm fuzzies here.

Maybe SDS is due Paul

22 days up; bad sign. see what the fed minutes say. Ready to short. 28oF – hate winter. Gld acting wild could be a run is in store Use stops, or short a hedge.