Good morning. Happy Wednesday. Happy Tax Day.

The Asian/Pacific markets closed with a lean to the downside. There were no big winners. China and Taiwan dropped more than 1%, followed by India (down 0.8%) and Australia (down 0.7%). Europe is currently mostly up. Italy is up 1%, followed by Russia (up 0.9%), Austria (up 0.8%), Amsterdam and Belgium (up 0.7%) and Norway, Stockholm and France (up 0.6% each). Futures here in the States point towards a solid up open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is up. Oil is up, copper down. Gold and silver are down. Bonds are up.

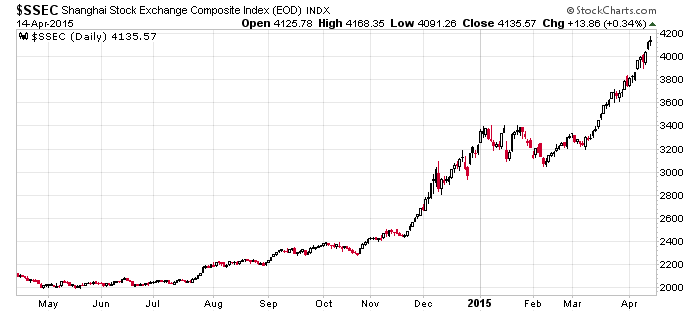

In a sign of how idiotic things are in China, the country’s GDP grew at its slowest pace since the financial crisis, yet here we are with the Chinese market having doubled since last summer. Bad news is good news. Bad news means more stimulus. It’s a big bubble. Not sure when it’ll pop, but when it does, it’ll be reminiscent of the dot-com bubble busting in the US.

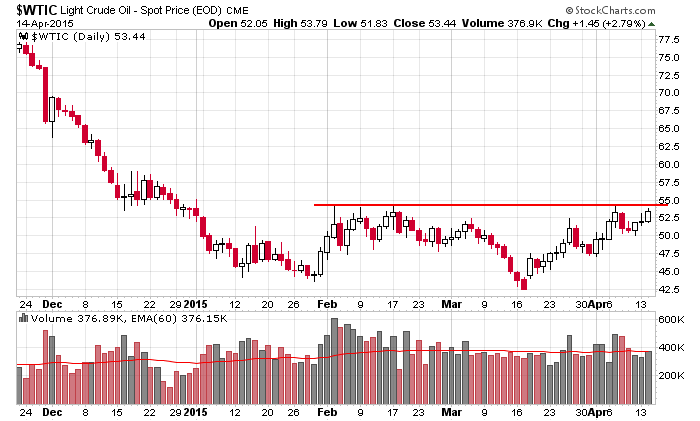

Oil posted a solid gain yesterday, and many oil stocks on our Long List rallied very nicely. Crude is once again close to breaking out. Resistance is just overhead. If it can breakout and get a little follow through, oil stocks should be safe to play for the next couple weeks. It’s a big group…lots of stocks to pick from, so lots of money to be made if it happens.

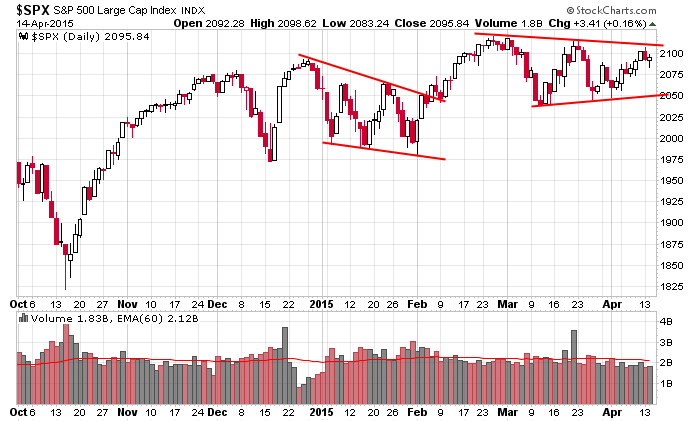

To the market, here what I see with the daily S&P. Going back to November, the index has traded in an upward-sloping channel. Over the last two months it has traded in a symmetrical triangle pattern characterized by converging trendlines which act to build pressure and energy into the underlying. Until the pattern resolves, we can’t be overly opinionated. My bias is to the upside (hence why there are many set ups on the Long List but very few on the Short List), but in the back of my mind I keep reminding myself things can change fast. Have a plan. Have a contingency plan. I’m long but not all in.

Options expire Friday. Earnings season picks up next week. More after the open.

Stock headlines from barchart.com…

Delta Air Lines (DAL +0.02%) reported Q1 adjusted EPS of 45 cents, better than consensus of 44 cents.

Nokia (NOK -4.10%) was upgraded to ‘Market Perform’ from ‘Underperform’ at Bernstein.

Staples (SPLS -0.12%) was upgraded to ‘Buy’ from ‘Hold’ at BB&T with a price target of $21.

American Eagle Outfitters (AEO -2.07%) was initiated with a ‘Buy’ at Guggenheim witha proce target of $20.

Discover (DFS +0.95%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

Cummins (CMI +0.32%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

PNC Financial Services Group (PNC +0.32%) reported Q1 EPS of $1.75, better than consensus of $1.72.

Bank of America (BAC +0.13%) reported Q1 EPS of 36 cents, higher than consensus of 29 cents.

US Bancorp (USB -1.27%) reported Q1 EPS of 76 cents, right on expectations.

Piper Jaffray keeps an ‘Overweight’ rating on L Brands (LB -0.01%) and raised its price target on the stock to $102 from $91.

Ulta Salon (ULTA +0.98%) , Nike (NKE +0.26%) , and GoPro (GPRO +0.59%) were all upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

CSX (CSX +0.39%) rose almost 3% in after-hours trading after it reported Q1 EPS of 45 cents, better than consensus of 44 cents.

Intel (INTC -0.76%) reported Q1 EPS of 41 cents, right on consensus, although Q1 revenue of $12.8 billion was below consensus of $12.9 billion and the company said it sees fiscal 2015 revenue approximately flat, below consensus of $55.69 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Empire State Mfg Survey

9:00 Fed’s Bullard: U.S. Economy and Monetary Policy

9:15 Industrial Production

10:00 Atlanta Fed’s Business Inflation Expectations

10:00 NAHB Housing Market Index

10:30 EIA Petroleum Inventories

2:00 PM Fed’s Beige Book

4:00 PM Treasury International Capital

Notable earnings before today’s open: ASML, BAC, DAL, MEA, PNC, PGR, TITN, USB, WSO

Notable earnings after today’s close: CNS, KMI, NFLX, SNDK, UMPQ, WTFC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

4 thoughts on “Before the Open (Apr 15)”

Leave a Reply

You must be logged in to post a comment.

Long ASHS, China bubble is likely, but up for a while. Today the US has hopes for a short up move.

I am long MGK and looking at vietname. Nuts maybe but Draghi today said no rate increases, so EU wants to let growth happen. China? An old story HSI has had such runs. I am up 38% with stop/limit. Let me dream. Old men are silly often, and that includes me. Watch US treasuries,they want to move up above 164, try TlT.

best to all.

bac report .26 c a share below .27 estimate. not what u wrote .36 c above be careful u cost me money

I cost you money? That’s a joke. I copied and pasted from barchart.com, and nobody but yourself is responsible for your own actions.

bac report .26 c a share below .27 estimate. not what u wrote .36 c above be careful u cost me money