Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China rallied 2.7% followed by Taiwan (up 1.2%), South Korea (up 0.9%) and Australia (up 0.7%). Europe is currently mostly down. Germany, Italy and Spain are down more than 1%. France, Belgium and Stockholm are down 0.6-0.7%. Futures here in the States point towards a moderate gap down open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is down. Oil is down, copper is up. Gold and silver are up. Bonds are up.

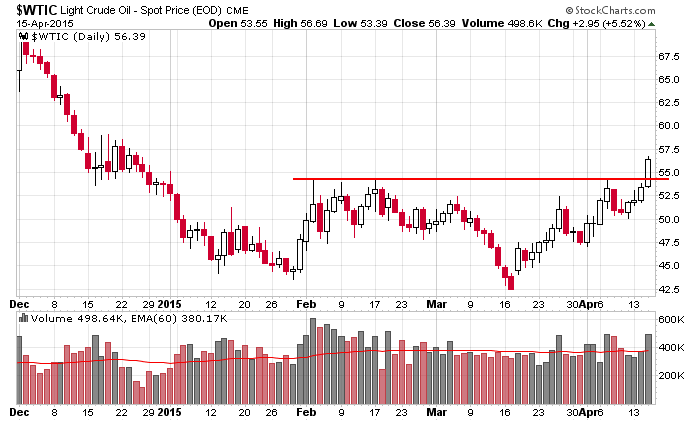

Yesterday we got a breakout in oil. Now we need some follow through to confirm the move.

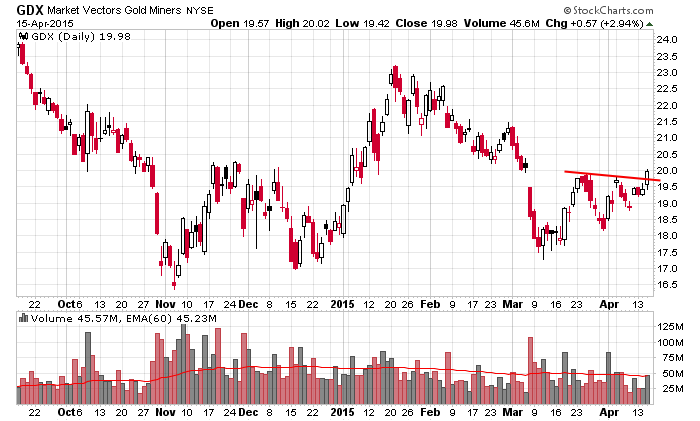

The next group that may move is gold. It has swung up and down for many months and now seems to be on an up swing. There are no guarantees here, but at a quick glance, several stocks have perked up lately. Here’s GDX.

Netflix (NFLX) is 11.7% in premarket trading. They added more subs worldwide than expected.

Panera (PNRA) is up 10.8% premarket. They are going to sell 73 cafes and increase their buyback.

SanDisk (SNDK) is down 7.2%. They forecasted a drop in full-year revenue and are going to cut costs by cutting 5% of its non-factory employees.

Welcome to earnings season. And this comes off Intel (INTC) jumping 4.3% yesterday.

I still like oil…we may get an important test soon. I’m warming up to gold. And unless you plan on holding for a long time, watch out for earnings. More after the open.

Stock headlines from barchart.com…

Shermin-Williams (SHW -0.50%) reported Q1 EPS of $1.38, below consensus of $1.44.

Goldman Sachs (GS +1.71%) reported Q1 EPS of $5.94, well above consensus of $4.26.

Grainger (GWW +1.55%) reported Q1 adjusted EPS of $3.10, weaker than consensus of $3.11.

Philip Morris International (PM +0.03%) reported Q1 EPS of $1.16, above consensus of $1.01.

UnitedHealth Group (UNH -2.17%) reported Q1 EPS of $1.46, better than consensus of $1.35.

BlackRock (BLK +0.80%) reported Q1 EPS of $4.89, higher than consensus of $4.52.

McDonald’s (MCD -1.17%) was initiated with a ‘Buy’ at Guggenheim with a price target of $108.

Chipotle (CMG -0.04%) was initiated with a ‘Buy’ at Guggenheim with a price target of $780.

Dunkin’ Brands (DNKN -0.58%) was initiated with a ‘Buy’ at Guggenheim wth a price target of $53.

The FDA approved Amgen’s (AMGN +1.78%) Corlanor drug to treat heart failure.

Starbucks (SBUX -0.33%) was initiated with an ‘Outperform’ at BMO Capital with a price target of $56.

Kinder Morgan (KMI +0.98%) reported Q1 EPS of 22 cents, below consensus of 23 cents.

SanDisk (SNDK +1.14%) fell over 7% in after-hours trading after it reported Q1 EPS of 62 cents, weaker than consensus of 66 cents, and then lowered guidance on fiscal 2015 revenue view to $5.4 billion-$5.7 billion from $6.5 billion-$6.8 billion, below consensus of $6.15 billion.

Netflix (NFLX -0.68%) surged over 12% in after-hours trading after it reported Q1 EPS of 38 cents, below consensus of 69 cents, but said it added a record 4.9 million new members globally in Q1, well above its forecast of 4.1 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Housing Starts

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Philly Fed Business Outlook

10:30 EIA Natural Gas Inventory

1:00 PM Fed’s Lockhart: U.S. Economy and Monetary Policy

1:10 PM Fed’s Loretta: U.S. Economy and Monetary Policy

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ADS, BLK, BX, C, FCFS, FCS, FRC, GS, GWW, HOMB, KEY, PBCT, PM, PPG, PVTB, SHW, SON, TSM, TZOO, UNH, WBS

Notable earnings after today’s close: AMD, ASB, AXP, CCK, CE, CYT, EGP, MAT, NOW, SLB

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers