Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. China rallied almost 5%, Hong Kong more than 2% and Australia, India and South Korea more than 1%. Europe is currently mostly up. London, France, Belgium, Netherlands, Norway, Sweden, Greece, Spain, Italy and Portugal are up more than 1%. Futures here in the States point towards a flat open for the cash market.

Report: Comparing 2015 to 2011

The dollar is up. Oil is up, copper is up. Gold and silver are up. Bonds are down.

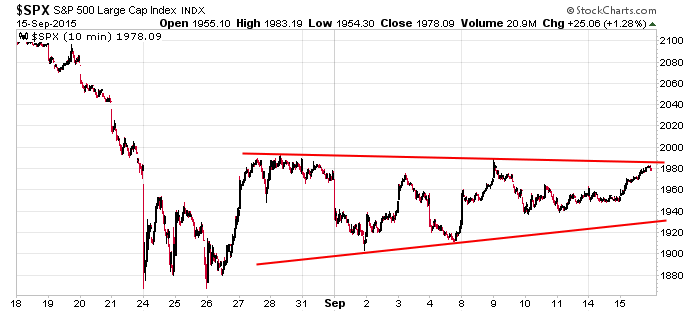

The market posted a solid gain yesterday, and now the S&P sits near the top of its consolidation range. Here’s the 10-min chart going back a month.

All eyes are on the Fed. The 2-day FOMC meeting starts today and will culminate tomorrow with their statement regarding the economy and rates. Because of the 200-point SPX drop last month most so-called experts believe the Fed will hold off raising rates. I don’t disagree. While I wish they would raise just a little bit – mostly to get it over with – the Fed is more likely to err on the side of raising too late rather than raising too early. In either case, the market is likely to be quiet today and tomorrow leading up to the statement.

In the near term I still favor the upside. If we do get a pop, we’ll have to see how much the internals improve. If there’s broad-based participation, then the odds favor the gains holding. But if few stocks participate, the market will go back down. Keep it simple. More after the open.

Stock headlines from barchart.com…

FedEx (FDX +2.51%) reported Q1 EPS of $2.42, weaker than consensus of $2.46.

Carter’s (CRI +0.85%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

Oracle (ORCL +1.14%) was upgraded to ‘Buy’ from ‘Neutral’ at SunTrust.

Hasbro (HAS +1.93%) was initiated with a ‘Buy’ at Sterne Agee CRT with a price target of $84.

LinkedIn (LNKD +0.61%) was upgraded to ‘Hold’ from ‘Sell’ at Brean Capital.

SanDisk (SNDK +0.70%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

AMC Networks (AMCX +2.49%) rose over 2% in after-hours trading after Bloomberg reported that AMC is in talks to acquire Starz (STRZA +1.39%) .

Gabelli reported a 6.8% stake in Madison Square Garden (MSG +2.66%).

Vertex (VRTX +0.44%) was initiated with a ‘Buy’ at Nomura with a price target of $162.

DENTSPLY International (XRAY +1.36%) and Sirona Dental Systems (SIRO +1.24%) announced that the Boards of Directors of both companies have unanimously approved a definitive merger agreement under which the companies will combine in an all-stock merger of equals.

Genuine Parts (GPC +2.24%) was initiated with a ‘Buy’ at Jefferies with a price target of $95.

O’Reilly Automotive (ORLY +2.10%) was initiated with a ‘Buy’ at Jefferies with a price target of $290.

Six Flags (SIX -0.04%) was initiated with a ‘Buy’ at Janney Capital with a price target of $55.

Yandex (YNDX +1.58%) was upgraded to ‘Neutral’ from ‘Sell’ at Goldman Sachs.

United Natural Foods (UNFI +1.56%) reported Q4 EPS of 72 cents, right on consensus.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

FOMC meeting begins

7:00 MBA Mortgage Applications

8:30 Consumer Price Index

10:00 NAHB Housing Market Index

10:30 EIA Petroleum Inventories

4:00 PM Treasury International Capital

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 16)”

Leave a Reply

You must be logged in to post a comment.

dow and nas100 have made new correction highs and spx is right at it

this can indicate this is a wave 2 correction with a larger wave 3 down to come

alternatively its still in small corrective 4 of wave 1 and a smaller just below lows to come in small 5 down

where do u see spx correcting too?

jims,

if you look at Jasons 2011 chart you will see in late sept their was a wave 5 impulsive wave -fAST

TO NEW LOWS after corective 4

however if infact our last low was a completed low we just saw in our market then this is a corrective wave 2 up we are in now [corective because its choppy and overlap and we have had a up and b down and now c up

we just past corrective a up in price and could be a deap up to nearly the price of the original

start of wave 1 down

technically this should end about 2000 to 2020

but with tomorrows fed ann it could spike much higher before the start of MASSIVE WAVE 3 DOWN

FOR A LUXURIOUS 4000 DOW POINTS DOWN

their is a GANN turn date of 90 days from last high on 17th sept and has been vibrating fairly well to the 90 days which can run out to 96 days

elliott wave is had to show with out a chart and i dont know how to post one

thanks aussie…much appreciated..

spx 1960-65?