Good morning. Happy Thursday. Happy Fed Day.

The Asian/Pacific markets closed mostly up. China dropped 2.1%. Japan, Singapore, Australia, India, Indonesia, Malaysia and Taiwan rallied 0.9% or more. Europe is currently mixed and little moved from its unchanged levels. Spain, Portugal, Turkey and Norway are doing the best. Futures here in the States point towards a down open for the cash market.

Subscribe to Leavitt Brothers today.

The dollar is down. Oil is down, copper is down. Gold and silver are down. Bonds are up.

Today has finally arrived. Two months ago it was almost a foregone conclusion the Fed would raise rates today, but with the market plunging last month, odds now favor them staying pat and waiting.

I wish they would raise a little. Sure the market may take a hit in the near term, but the world could stop obsessing over it and focus on things that are more important. I did a podcast with AIREX Market about the Fed and rates. You can listen to it here.

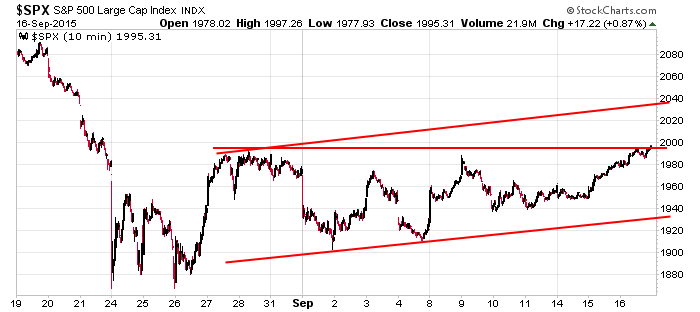

Here’s an update of the 10-min SPX chart I’ve been posting. The index is near the high of its 4-week range. Another trendline to identify a potential upside target in the high 2030’s has been drawn.

News trumps the charts, so anything goes later today and tomorrow. Don’t put yourself in a position where you can lose a lot of money for unknown reasons. More after the open.

Stock headlines from barchart.com…

Oracle (ORCL +0.74%) slid over 1% in pre-market trading after it reported Q1 EPS of 53 cents, better than consensus of 52 cents, although Q1 revenue of $8.45 billion was below consensus of $8.53 billion.

Raytheon (RTN +0.04%) was upgraded to ‘Top Pick’ from ‘Outperform’ at RBC Capital.

Hasbro (HAS +1.48%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

NVIDIA (NVDA +0.70%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies with a $30 price target.

Stanley Black & Decker (SWK +0.44%) was initiated with a ‘Buy’ at UBS with a price target of $120.

Hanesbrands (HBI +1.17%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Cablevision (CVC unch) jumped over 16% in pre-market trading after after Altice announced that it will acquire Cablevision for $34.90 per share in cash.

Clarcor (CLC +0.58%) reported Q3 non-GAAP EPS of 66 cents, weaker than consensus of 84 cents, and then lowered guidance on fiscal 2015 EPS view to $2.70-$2.80 from $3.00-$3.15, below consensus of $3.05.

Northrop Grumman Corporation (NOC +0.37%) announced that its board has authorized an additional $4 billion for the repurchase of the company’s common stock.

Aetna (AET +0.01%) backs its fiscal 2015 EPS view of at least $7.40, below consensus of $7.51.

Envision Healthcare (EVHC -0.09%) was initiated with a ‘Buy’ at Canaccord with a price target of $51.

Allscripts (MDRX +0.59%) was initiated with a ‘Buy’ at Canaccord with a price target of $18.

Herman Miller (MLHR +1.24%) climbed 4% in after-hours trading after it reported Q1 EPS of 56 cents, well above consensus of 46 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Housing Starts

8:30 Current Account

9:45 Bloomberg Consumer Comfort Index

10:00 Philly Fed Business Outlook

10:30 EIA Natural Gas Inventory

2:00 PM FOMC Announcement

2:00 PM FOMC Forecast

2:00 PM Chairman Press Conference

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 17)”

Leave a Reply

You must be logged in to post a comment.

What the fed does matters very little because its in the name of virtue not economics. The dark pools have not been buying stocks, no interest in losses. HFT have been bucking the market for a few licks scattering the chickens. I look for more selling, but let the brave lead the way into the future. Staying with dividend stocks that tend to grow a little. My biotechs are positive, and holding some indices since they are wind vanes….aren’t they?

PLACE UR BETS..SHOW TIME