Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down, but losses were small. China rallied 2.3%, and Hong Kong and Singapore also did well. Japan, South Korea, Malaysia and Indonesia posted losses. Europe is currently mostly down. The Czech Republic, Greece and Poland are down more than 1%; Austria, Russia, Germany, Hungary and Spain are also weak. London is up. Futures here in the States point towards a flat open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

——————

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are down.

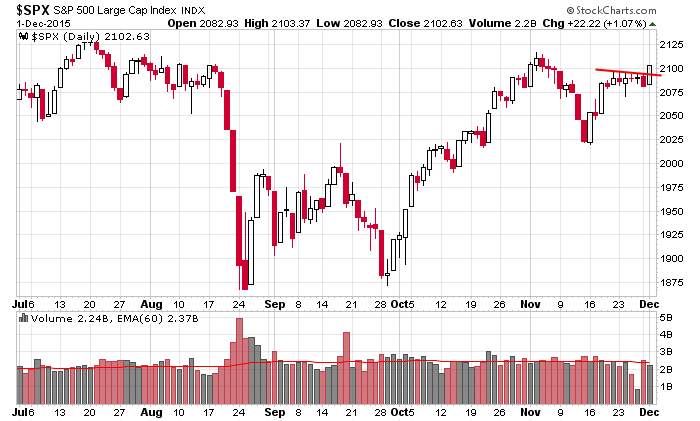

The S&P cleanly broke out of its 7-day consolidation pattern yesterday. It was a nice move on decent volume, but there’s work to do. There’s lots of resistance overhead from the early-November high and the all-time high established over the summer. Here’s the daily chart.

December is the best month of the year, and according to Ryan Detrick, it’s even better when the first day of the month is up > 1%, which is what took place yesterday.

The internals have improved. The AD line, AD volume line, new highs and others have moved up to confirm the market’s strength…but it obviously has to continue. There isn’t much room for error at these high levels.

I like the market, but I don’t love it. I’m long but not all in. I’m still in “swing for singles” mode and not placing big bets. I guess you can say I’m content to grind it out. More after the open.

Stock headlines from barchart.com…

Yahoo! (YHOO -0.30%) jumped over 8% in pre-market trading after the WSJ cited people familiar with the matter as saying the company’s board will consider the sale of its main Internet business.

Fitbit (FIT +1.74%) rose nearly 3% in pre-market trading after the U.S. International Trade Commission said it would investigate a patent complaint filed by Fotbit against Jawbone Inc.

Bristol-Myers Squibb (BMY +1.87%) was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim Securities with a price target of $82.

Lockheed Martin (LMT +0.47%) won a Pentagon contract worth $914 million to upgrade F-16 aircraft for Singapore’s military.

Louisiana-Pacific (LPX -2.45%) was added to the ‘Top Pick’ list at RBC.

Bob Evans (BOBE +0.13%) slid nearly 5% in after-hours trading after it lowered guidance on its fiscal 2016 revenue estimate to $1.35 billion from a prior view of $1.33 billion-$1.39 billion, below consensus of $1.36 billion.

Mobileye (MBLY -0.32%) rose 1% in after-hours trading after the stock was rated a new ‘Buy’ at Evercore ISI with a price target of $68.

Powell Industries (POWL -0.31%) slumped 10% in after-hours trading after it reported Q4 adjusted EPS of 45 cents, below consensus of 48 cents, and then lowered guidance on fiscal 2016 adjusted EPS to 65 cents-$1.05, well below consensus of $1.62.

Guidewire Software (GWRE +2.06%) rose over 4% in after-hours trading after it reported Q1 adjusted EPS of 7 cents, over double consensus of 3 cents.

Ascena Retail (ASNA +3.97%) jumped over 7% in after-hours trading after it reported Q1 adjusted EPS of 36 cents, higher than consensus of 29 cents.

Culp (CFI +2.66%) reported Q2 EPS of 41 cents, better than consensus 40 cents, although Q2 revenue of $77.0 million was below consensus of $77.6 million.

OncoGenex Pharmaceuticals (OGXI +1.55%) plunged over 25% in after-hours trading after it said some patients in its prostate cancer drug study did not respond to treatment with its custirsen drug.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Productivity and Costs

8:30 Gallup U.S. Job Creation Index

9:00 Daniel Tarullo speech

10:30 EIA Petroleum Inventories

12:25 PM Janet Yellen speech

2:00 PM Fed’s Beige Book

3:40 PM Fed’s Williams: Economic Outlook

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 2)”

Leave a Reply

You must be logged in to post a comment.

There are various potential market moving scheduled meetings via economic calender throughout the month of Dec. Starting today this week with Janet Yellen @ 12:25 PMET. (But not as significant as tomorrows testimony before the Joint Econimic Committee in Washington. The Beige Book at 2PMET. This book is produced roughly 2 weeks before the monetary policy meetings of the FOMC (Dec. 15 & 16),where the Fed sets interest rate policy and are the single most influential event for the markets. Speculators can and will anticipate in advance about the possibility of an interest rate change that could be announced upon the end of these meetings. Also OPEC’s Dec. 4 meeting in Vienna will influence crude oil price move. On Fri. we have the jobs report (NFP status). This week and the rest of the month will likely be volatile. Such conditions can make or break projections and outlooks of the financial markets. Keep an out and stay focused.

a sky high,false break ,black swan dive into high noon

no doubt a trend change to spx 666 by father xmas