The flow of money tells us investor’s risk appetite. When more money flows into safe, large caps that have long track records, it’s a sign investors are looking for safety. They’re less concerned with making money and more concerned with not losing. When money flows into riskier small caps that have much higher upside, but also much bigger downside potential, it’s a sign investors are comfortable and confident enough to take a chance. They aren’t worried too much about losing; times are good and they want to press.

The flow of money partially shows up in the performance of the large caps vs. small caps. When the large caps lead, it’s a risk-off environment, and the market’s upside potential is capped. When the small caps lead, it’s a risk-on environment, and the entire market tends to do pretty well.

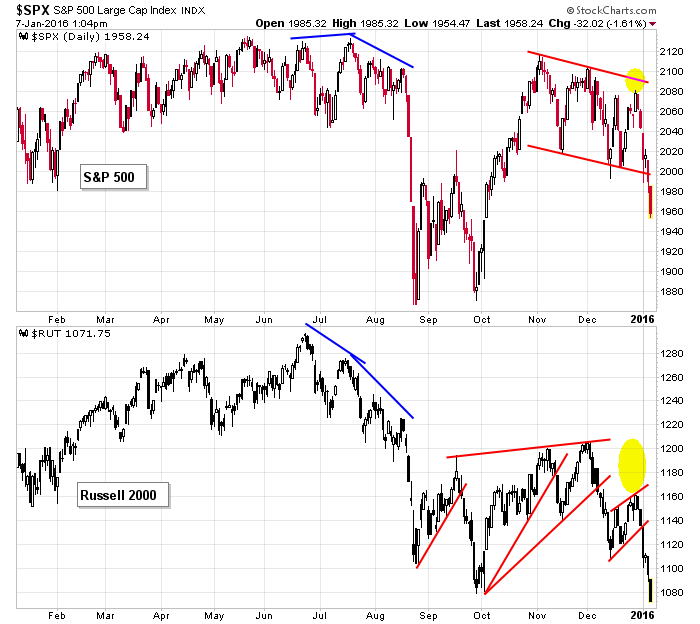

Here are the daily S&P 500 (large caps) and Russell 2000 (small caps) charts. The indexes tracked each other pretty well the first half of 2015 but then started to diverge in mid June. The S&P pushed higher while the Russell put in an obvious lower high. The under-performance has continued, and although the large caps could be considered in a consolidation pattern near its high, the small caps are stuck in a downtrend. As long as this remains the case, the market’s will be under pressure.

Agree/Disagree? Comment below. And click here to join our email list to get reports just like this sent directly to you.

![]()