Rates are going up, perhaps slowly, but still going up. Lower rates didn’t help the general public, but they definitely helped corporate America.

Companies that have a lot of debt may have to refinance at higher rates.

M&A activity, which has greatly helped the market, could dry up (2015 was a record year) if companies no longer have access to cheap money to fund the activity. M&A decreases the float of the overall market, and therefore helps the market rally.

Stock buybacks have greatly helped the market over the last few years. Companies borrow money, and then turn around and buy their own stock. Higher rates won’t stop this, but it’ll slow it down.

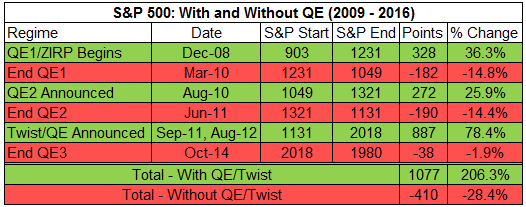

QE, or quantitative easing, has also been a big supporter of higher stock prices. Here’s an image from Pension Partners showing the market’s performance since 2008, with and without QE.

Agree/Disagree? Comment below. And click here to join our email list to get reports just like this sent directly to you.

![]()