Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Hong Kong, Singapore, Australia and India dropped more than 1%; Malaysia, Taiwan and Japan were also weak. China and New Zealand did well. Europe is currently posting sizable, across-the-board losses. Belgium and Greece are down more than 3%, and Germany, France, Norway, the Czech Republic, Denmark, Spain and Italy are down more than 2%. Futures in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are up. Bonds are up.

For 6+ weeks the market has rolled around in a range. Down, up, down, up, and now back down. On the way down, news is bad and everyone is genuinely worried. On the way up, news improves (or bad news is scarce), and investor feel better (recency bias). Then a week later prices are unchanged.

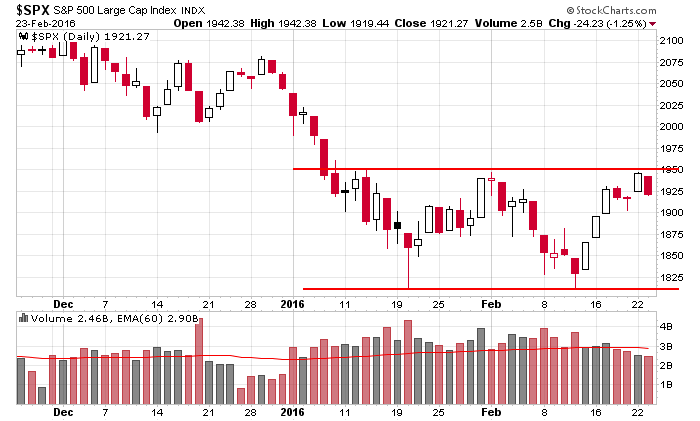

Here’s the S&P – a 140-point range. Rallies get solid, dips get bought. This is the nature of a top/beginning of a downtrend. There are long periods of indecision followed by sudden surges or plunges.

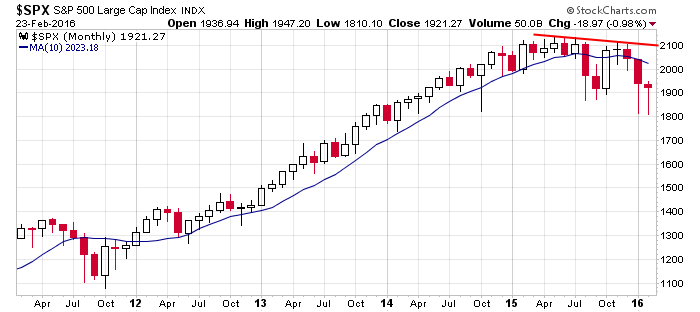

Backing up, here’s the monthly with the 10-month MA. As long as the S&P trades below its the declining MA, I’ll consider the trend to be down. Keep it simple.

The character and personality of bear markets are different than bull markets. Know the difference. Adjust. More after the open.

Stock headlines from barchart.com…

Avis-Budget Group (CAR +1.01%) tumbled over 12% in after-hours trading after it lowered guidance on fiscal 2016 adjusted EPS to $2.70-$3.30, below consensus of $3.43.

Ford Motor (F -1.11%) was downgraded to ‘Underperform’ from ‘Neutral’ at Credit Suisse.

DreamWorks Animation(DWA -2.09%) jumped over 7% in after-hours trading after it reported Q4 adjusted EPS of 55 cents, over three times expectations of 15 cents.

WebMD Health Corp. (WBMD -0.19%) rose almost 3% in after-hours trading after it said it sees 2016 revenue of $685 million-$8705 million, above consensus of $689.3 million.

Dycom Industries (DY -0.65%) slumped 15% in after-hours trading after it reported Q2 adjusted EPS of 54 cents, weaker than consensus of 56 cents, and hen said it sees Q3 EPS of 70 cent-80 cents, below consensus of 84 cents.

Deere & Co. (DE -1.61%) was upgraded to ‘Buy’ from ‘Hold’ at Argus Research.

Copart (CPRT -0.66%) reported Q2 EPS of 48 cents, higher than consensus of 43 cents.

Ormat Technologies (ORA -0.38%) raised guidance on fiscal 2016 revenue to $620 million-$640 million, higher than consensus of $608.7 million.

MSA Safety (MSA +0.26%) reported Q4 adjusted EPS of 84 cents, better than consensus of 68 cents,

Trexx Co. (TREX +9.75%) gained almost 2% in after-hours trading after it reported it will replace Snyder’s-Lance in the SmallCap 600 after the close of trading Wednesday, February 24.

AMAG Pharmaceuticals (AMAG +1.11%) rose over 3% in after-hours trading after it reported it will replace Diamond Foods (DMND +0.97%) in the SmallCap 600 after the close of trading Monday. February 29.

Snyder’s-Lance (LNCE +1.47%) climbed almost 2% in after-hours trading after it reported it will replace California Resources in the MidCap 400 at the close of trading Wednesday, February 24.

Morgan Stanley (MS -3.38%) said its energy loan exposure at the end of Q4 was $15.9 billion, down from $17.2 billion at the end of Q3.

Advisory Board Co. (ABCO -1.31%) was downgraded to ‘Market Perform’ from ‘Market Outperform’ at Avondale Partners LLC with a 12-month price target of $31.

Earnings and Economic Numbers from seekingalpha.com…

Tuesday’s Key Earnings

Avis Budget (NASDAQ:CAR) -13.3% AH stung by weak guidance.

DreamWorks Animation (NASDAQ:DWA) +9.7% AH after a 36% gain in Q4 revenues.

Etsy (NASDAQ:ETSY) +15.7% AH on strong revenue, user growth.

First Solar (NASDAQ:FSLR) +1.3% AH after beating estimates.

Home Depot (NYSE:HD) +1.4% following an increase in comp-store sales.

Macy’s (NYSE:M) +3.1% as results came in above expectations.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:00 Fed’s Lacker: Monetary Policy

9:45 PMI Services Index Flash

10:00 New Home Sales

10:30 EIA Petroleum Inventories

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $34B, 5-Year Note Auction

1:15 PM Fed’s Kaplan: Monetary Policy

6:30 PM Fed’s Bullard speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 24)”

Leave a Reply

You must be logged in to post a comment.

Watch 1890,if hit today S&P could rally hard, like 1942+, or go much lower if 1890 violated. All based on fibs which often work well. Watching gold above 1265 for a leap, plat is being bought today maybe up too.

spot on so far

but i think any attempted rally will get sold hard

intraday reversed to long as europe turned but not convincingly yet

these are truely global markets

excellent T/A Jason

i was taught at school when price gets to top of channel sell for price to go to bottom

but in this case the bottom is a neck to a head and shoulders ,with a target of spx 1500 ish

double bottoms in bear markets never hold and lower double tops are sold

the bull mind set will be waiting for a breakout to the top,whilst the bears want a crash to the bottom

the day traders sit back and laugh with exhileration