Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across-the-board. Hong Kong rallied more than 3%, Japan and Singapore more than 2% and China, Australia, India and Taiwan did better than 1%. Europe is currently posting huge gains. Greece is down more than 1%, but Italy is up more than 3%, Germany, France and Spain are up more than 2%. and most other countries, including Russia, London, Belgium, the Netherlands, Austria, Norway, Sweden, Switzerland, the Czech Republic, Turkey, and Finland are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

—————

LB Daily – a quick look at the “there’s a bull market somewhere” concept.

—————

The dollar is up. Oil is down, copper is up. Gold and silver are down. Bonds are down.

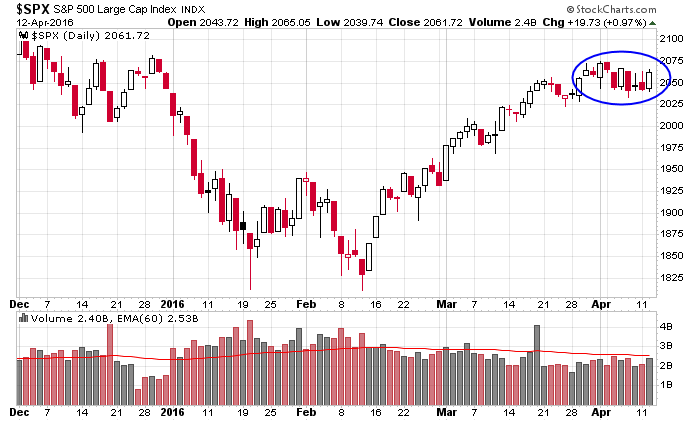

The market has been very noncommittal lately. Up one day, down the next. Nothing sticks, no follow through. Yesterday the S&P rallied 20 points. Today it’ll gap up 10 more. It’s the first time this month we’ll get a gap in the direction of the previous day’s move. Here’s the daily. Lots of back and forth action. If this was an individual stock, you’d call it a consolidation pattern within a newly formed uptrend.

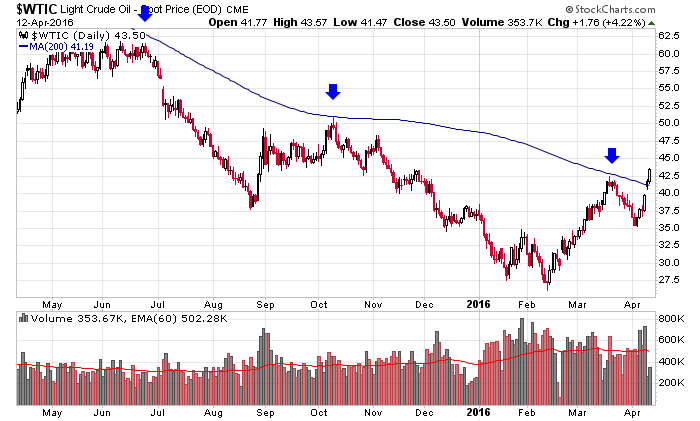

Oil continues to be a big winner. On Monday crude closed above its 200-day moving average after having closed below it for 472 days. Historically, crude has done well under this circumstance – spending a long time below the 200-day and then closing above it.

Oil stocks have done very well – some have doubled or tripled off their recent lows. I believe there’s a bull market in oil and will continue to buy dips, etc. But it won’t always be smooth sailing (it never is). PE did a secondary last week, and RICE just announced their own secondary.

We need the three weeks of consolidation to end…but even when it does, we’ll still stick with the leading groups. More after the open.

Stock headlines from barchart.com…

JPMorgan Chase (JPM +1.86%) is up nearly 2% in pre-market trading after it reported Q1 adjusted EPS of $1.41, higher than consensus of $1.25.

Stryker (SYK +1.11%) was downgraded to ‘Neutral’ from ‘Outperform’ at Baird.

Chipotle Mexican Grill (CMG +0.09%) and Yum! Brands (YUM +0.31%) were both downgraded to ‘Underperform’ from ‘Outperform’ at CLSA.

Wynn Resorts Ltd. (WYNN -1.14%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Western Digital (WDC -0.59%) was downgraded to ‘Neutral’ from ‘Buy’ at Longbow.

Healthcare Services Group (HCSG +0.74%) reported Q1 EPS of 26 cents, right on consensus, although Q1 revenue of $384.8 million was better than consensus of $378.8 million.

Tyson Foods (TSN +1.38%) was downgraded to ‘Outperform’ from ‘Buy’ at CLSA.

Foot Locker (FL +0.87%) gained over 1% in after-hours trading after it was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

The Brink’s Company (BCO +1.40%) was rated a new ‘Buy’ at BB&T Capital with a 12-month price target of $38.

Valeant Pharmaceuticals International (VRX +2.04%) dropped 2% in after-hours trading after the company said it received a default notice from some of its bondholders after it missed a deadline to file its annual report last month.

CSX Corp. (CSX +1.88%) fell 2% in after-hours trading after it reported Q1 EPS of 37 cents, right on consensus, but Q1 revenue of $704 million was below consensus of $707.9 million.

Rice Energy (RICE +8.18%) slid over 3% in after-hours trading after it started a public offering of 23.5 million shares of common stocks.

Acura Pharmaceuticals (ACUR -1.08%) jumped nearly 13% in after-hours trading after the U.S. Food & Drug Administration designated Acura’s hydromorphone with oral abuse-deterrent technology as a Fast Track development program for pain management in patients.

Tuesday’s Key Earnings

CSX Corp. (NASDAQ:CSX) +2.4% AH following in-line Q1 earnings.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Retail Sales

8:30 Producer Price Index

10:00 Business Inventories

10:00 Atlanta Fed’s Business Inflation Expectations

10:30 EIA Petroleum Inventories

1:00 PM Results of $20B, 10-Year Note Auction

2:00 PM Fed’s Beige Book

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 13)”

Leave a Reply

You must be logged in to post a comment.

lower double tops work in bear markets

The ratio of inventories to sales stayed at their highest level since the recession in February, efforts by companies to reduce stockpiles were also met by fewer sales.

Business inventories fell 0.1%, the Commerce Department said Wednesday, as a 0.5% decline in wholesale inventories and a 0.4% drop in manufacturer stockpiles was offset by a 0.6% rise in retail inventories.

Then, is am crude moved up to $42.17 bbl. Overall banks are suspect and a couple have confessed fraud.

other than that not a lot happening.

black swans are swarming

we haven’t had one in a while…love to see this pig tank..and cover the gap….ym that is…short at 17781

Bears propping this up?….advancers are not budging…2181-782